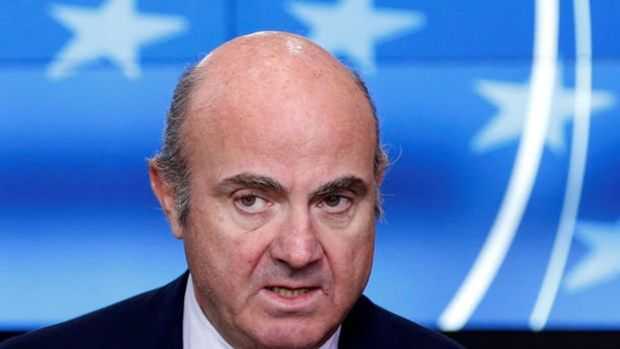

ECB/ Guindos: Banking turmoil casts shadow on interest rate policy

European Central Bank Vice President Luis de Guindos said the banking sector was “going through a period of very high uncertainty” and that this required a meeting-by-meeting approach to interest rate policy. “The question now is how the events in the US banking system and at Credit Suisse will affect the eurozone economy. In the coming weeks and months, we need to assess whether they will lead to an additional tightening of financing conditions,” he told the Business Post in an interview published on the ECB’s website on Sunday. Guindos said the ECB’s main concern for financial stability after the collapse of Credit Suisse Group AG was the situation of non-banks, which have a growing share of the financial system in Europe and have taken on too much risk over time. “We are not a supervisor of non-banks, but non-banks are interconnected with the traditional banks that we supervise and so we look at that sector as well,” Guindos said. He said the situation was very different from the financial crisis in 2008 because banks had much better capital and liquidity positions, well above the minimum requirements.