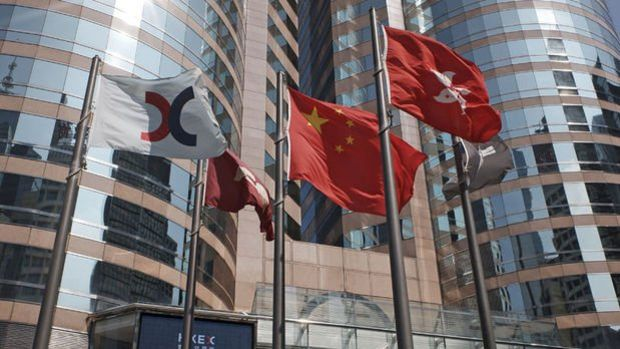

Hong Kong raises interest rates after Fed

Following the U.S. Federal Reserve’s (Fed) increase in its benchmark interest rate by 75 basis points, the Hong Kong Special Administrative Region of China increased its interest rate by the same percentage due to its dollar-pegged exchange rate regime. In a statement from the Hong Kong Monetary Authority (HKMA), the region’s de facto central bank, it was announced that the benchmark interest rate was increased by 75 basis points to 4.25 percent. The Fed raised its short-term policy rate by 75 basis points to the 3.75-4.00 percent range with the decision it made yesterday. The increase was the U.S. Federal Reserve’s sixth rate hike this year. The Fed had increased interest rates by 25 basis points in March, 50 basis points in May, and 75 basis points each in June, July, and September. The HKMA had followed the Fed’s decision in all increases and raised its benchmark interest rate by the same percentage. Interest rates at 14-year highs Following the increases, interest rates in Hong Kong have reached their highest level since the global financial crisis of 2008. The last time the benchmark interest rate in the region was as high as 3.75 in March 2008. Since Hong Kong’s currency, the Hong Kong dollar, was pegged to the dollar in 1983, the region has been following the Fed’s steps in monetary policy. Accelerating inflation had increased pressure on the Fed The tone of the Fed’s monetary policy had begun to change in the last quarter of 2021 with the pressure of high inflation that came with the rapid economic recovery following the Covid-19 outbreak in the US. Inflation, which continued to trend upward, due to the fact that the policies aimed at controlling the Covid-19 outbreak triggered by the Russia-Ukraine war and the Omicron variant in China increased the problems in the supply chain, further increased the pressure on the Fed. Inflation in the United States continued to be above expectations, although it reached 9.1 percent annually in June, the highest level since November 1981, then fell to 8.5 percent in July, 8.3 percent in August and 8.2 percent in September.