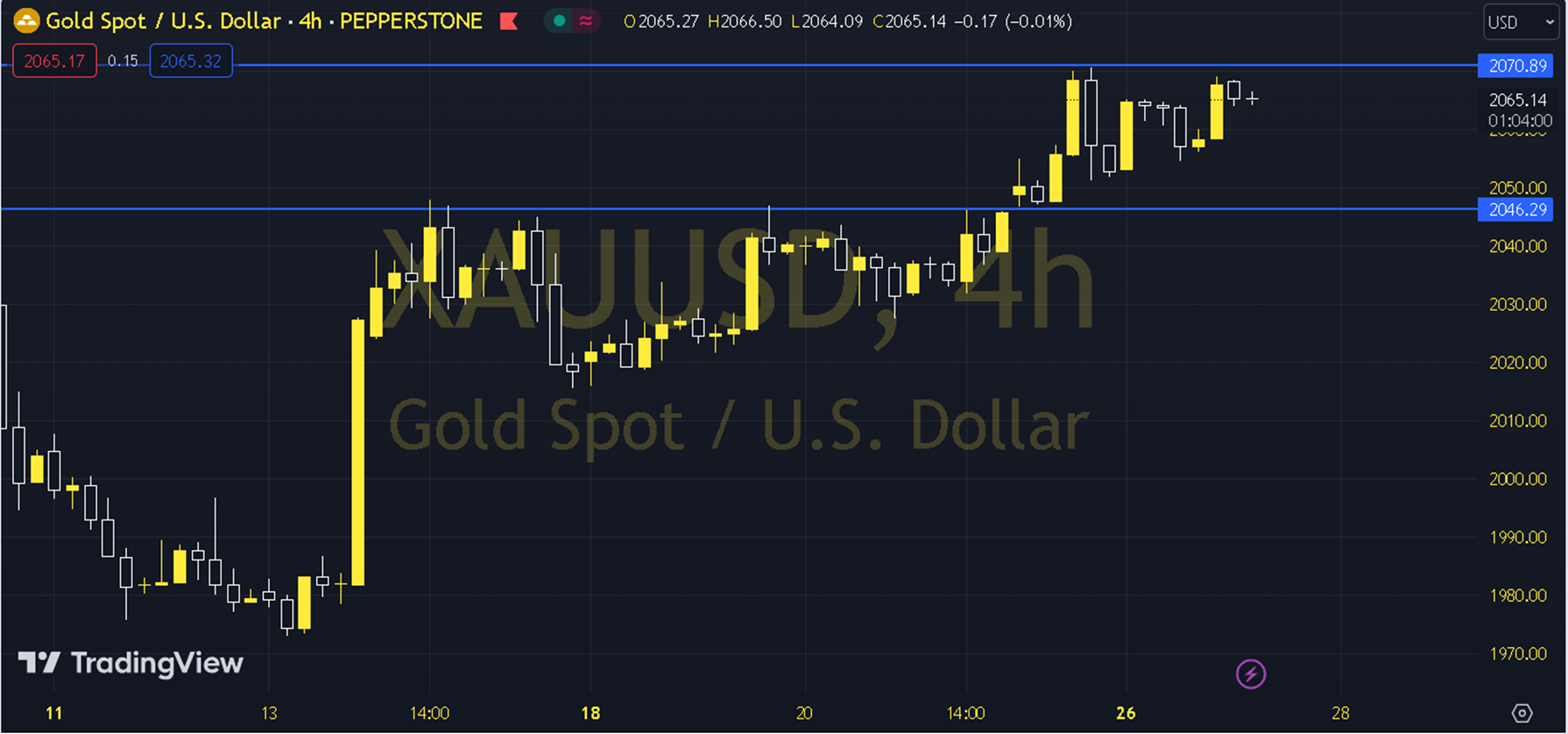

XAUUSD

Gold Ons The effect of the US 10-year Treasury bond yield limiting the declines, gold onslaught recorded an outlook that suppressed recoveries. When we technically evaluate the short-term gold onslaught pricing, we are following the 2040 - 2052 region, which is currently supported by the 34-period exponential moving average (2047). As long as the precious metal suppresses the pullback desire in the 2040 - 2052 region, the desire to rise may remain at the forefront. If the upward trend continues, there may be a movement area towards the 2070 and 2080 levels. In the alternative case, in order for the negative expectation to come to the fore, permanence may be required below the 2040 - 2052 region. In this case, the 2030 and 2021 levels may be encountered in the declines that may occur. Support: 2052-2040 Resistance: 2070-2080