BRENT

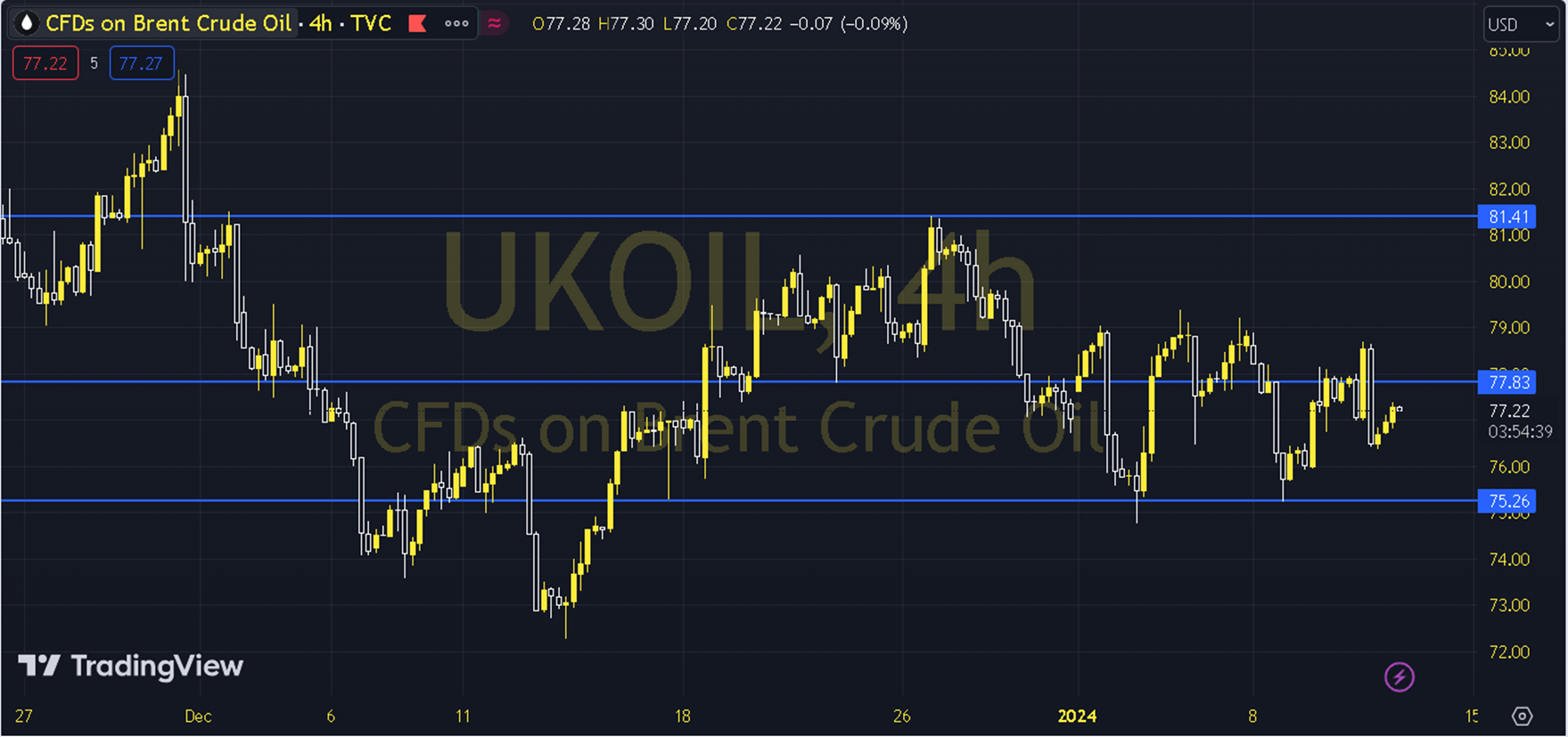

Despite the American Petroleum Institute's announcement of a 5.2 million barrel decrease in stocks, the US Energy Information Administration's surprising announcement of a 1.3 million barrel increase caused us to see a pullback in oil prices. Headlines that could potentially push oil up, such as Middle East tensions and OPEC cuts, are still current. The course of European and US stock markets and US inflation data can be followed during the day. As long as pricing remains below the 77.50 - 78.00 resistance, an upward and downward outlook may be at the forefront in the upcoming period. In possible declines, 76.50 and 76.00 levels can be targeted. In possible recoveries, the attitude of the 77.50 - 78.00 resistance can be monitored. Breaking this resistance and 4-hour closings in the region may bring the 78.50 and 79.00 levels to the agenda. In this process, as long as pricing remains below the 77.50 - 78.00 resistance, a downward outlook may be at the forefront. Support: 76.50 Resistance: 78.00