GBPUSD

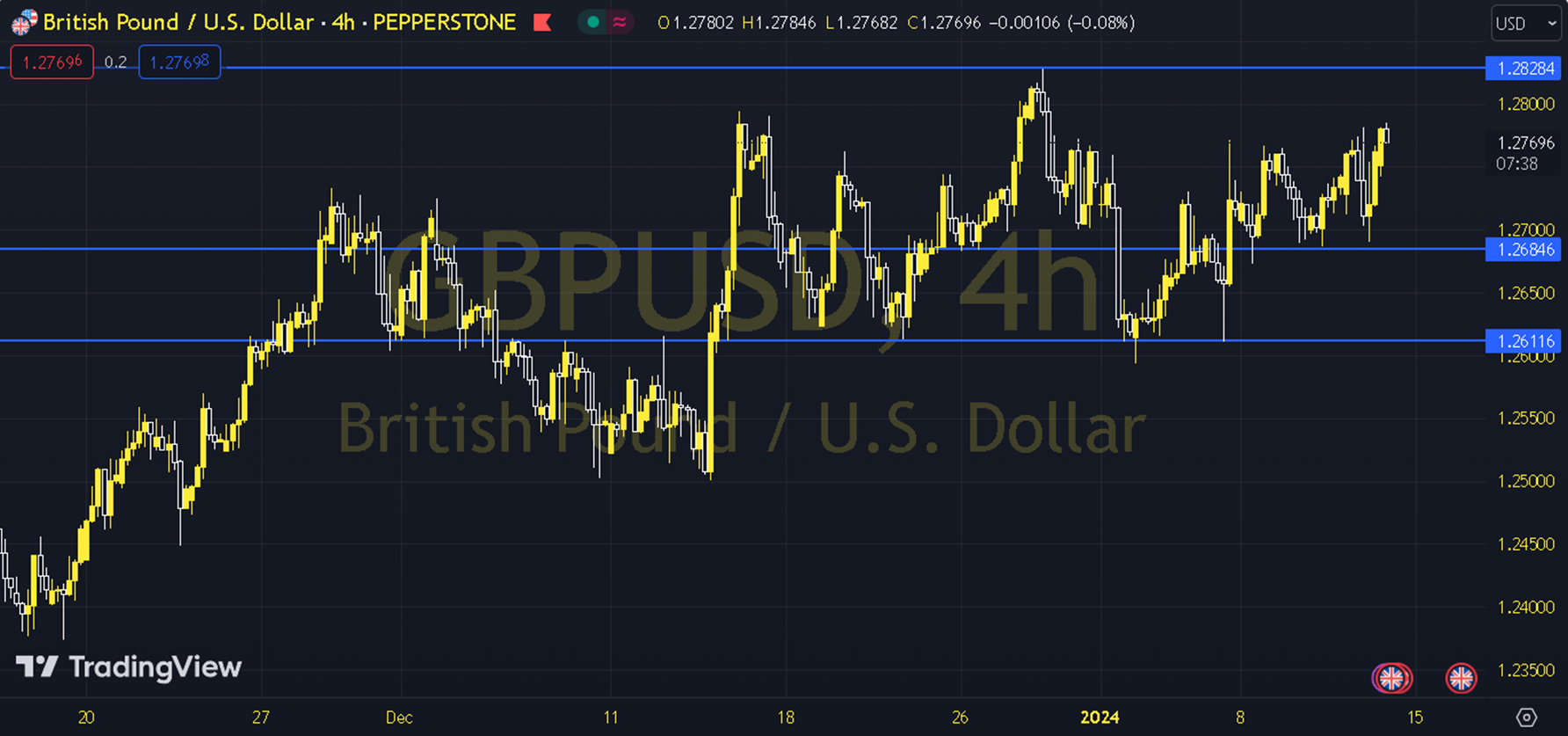

Before the critical developments for the GBPUSD parity, the Classic Dollar Index is in the decision phase in an important region. Today, the Growth and Industrial Production data from England will be important. In the short term, the 200-period average of 1.2639 maintains its importance for the GBPUSD parity, while the parity may want to continue its rise above the relevant average. With this in mind, pricing can be monitored towards the barriers of 1.2782, 1.2825 and 1.2875. Especially the channel's current upper point of 1.2875 is important. In terms of possible reaction thinking, as long as we do not follow a sharp news flow regarding the weak Sterling strong Dollar theme, the 200-period average continues to be the main support for the GBPUSD parity, and the intermediate support 34-period average 1.2726 can also be followed in terms of how eager the reaction thinking is. Support: 1.27260 Resistance: 1.28250