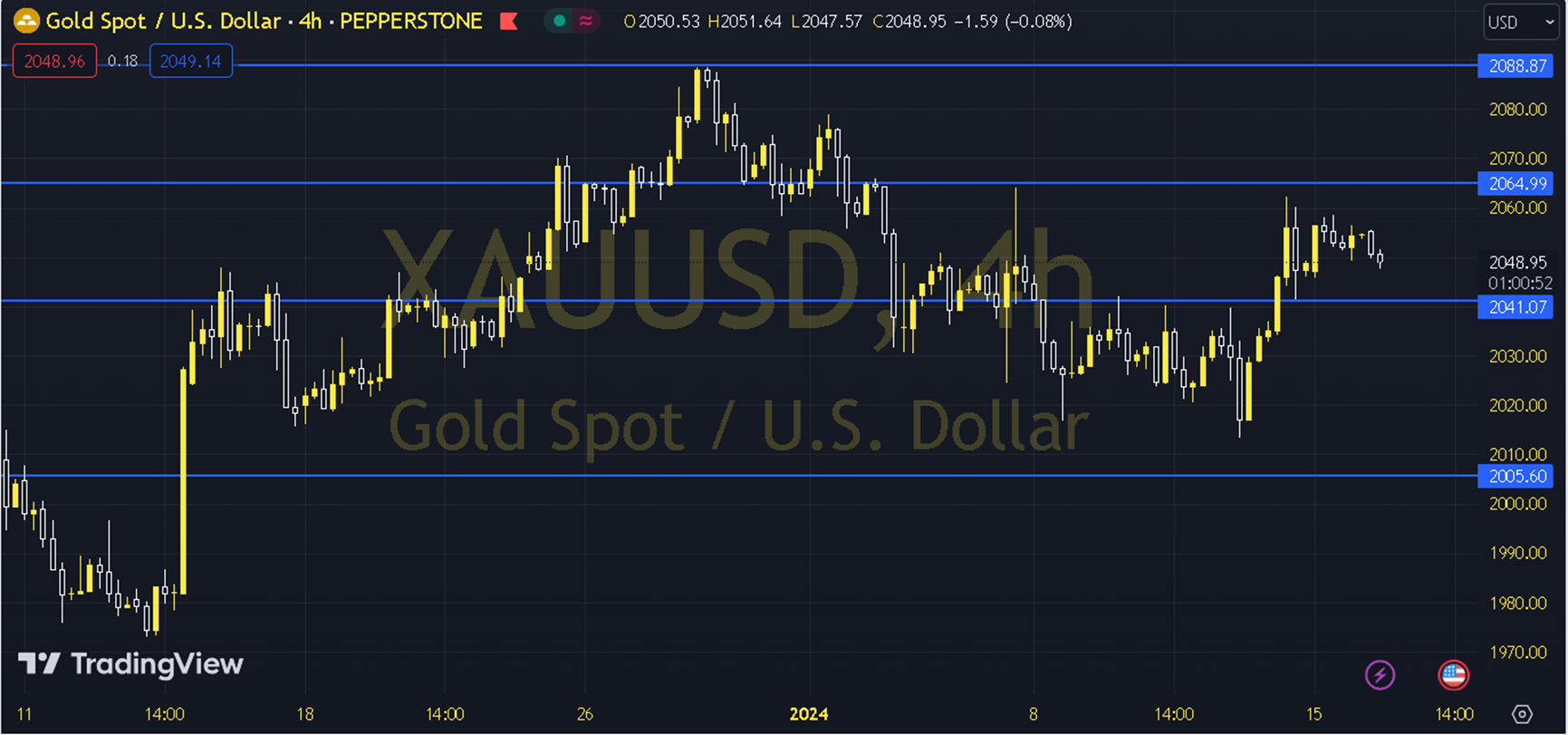

XAUUSD

The effect of the recovery of the US 10-year treasury bond yield towards 4% allowed the ounce of gold to see some pressure in the short term. The NY Empire State manufacturing index can be followed during the day due to its possible effects. When we evaluate the short-term ounce gold pricing technically, we are following the 2044 level, which is currently supported by the 34 (2044) period exponential moving average. As long as the 2044 level limits the downward demand in precious metal pricing, the positive trend may continue. If the upward demand continues, there may be movement towards the 2052 and 2061 levels. In the alternative case, it may be necessary to see persistence below the 2044 level for the negative trend to come to the fore. In this case, the 2033 and 2024 levels may be encountered in possible pullbacks. In the meantime, the attitude of the 2033 level, which is supported by the short-term trend line (falling), can be monitored for the continuation of the pullback expectation. Support: 2034-2027 Resistance: 2052-2061