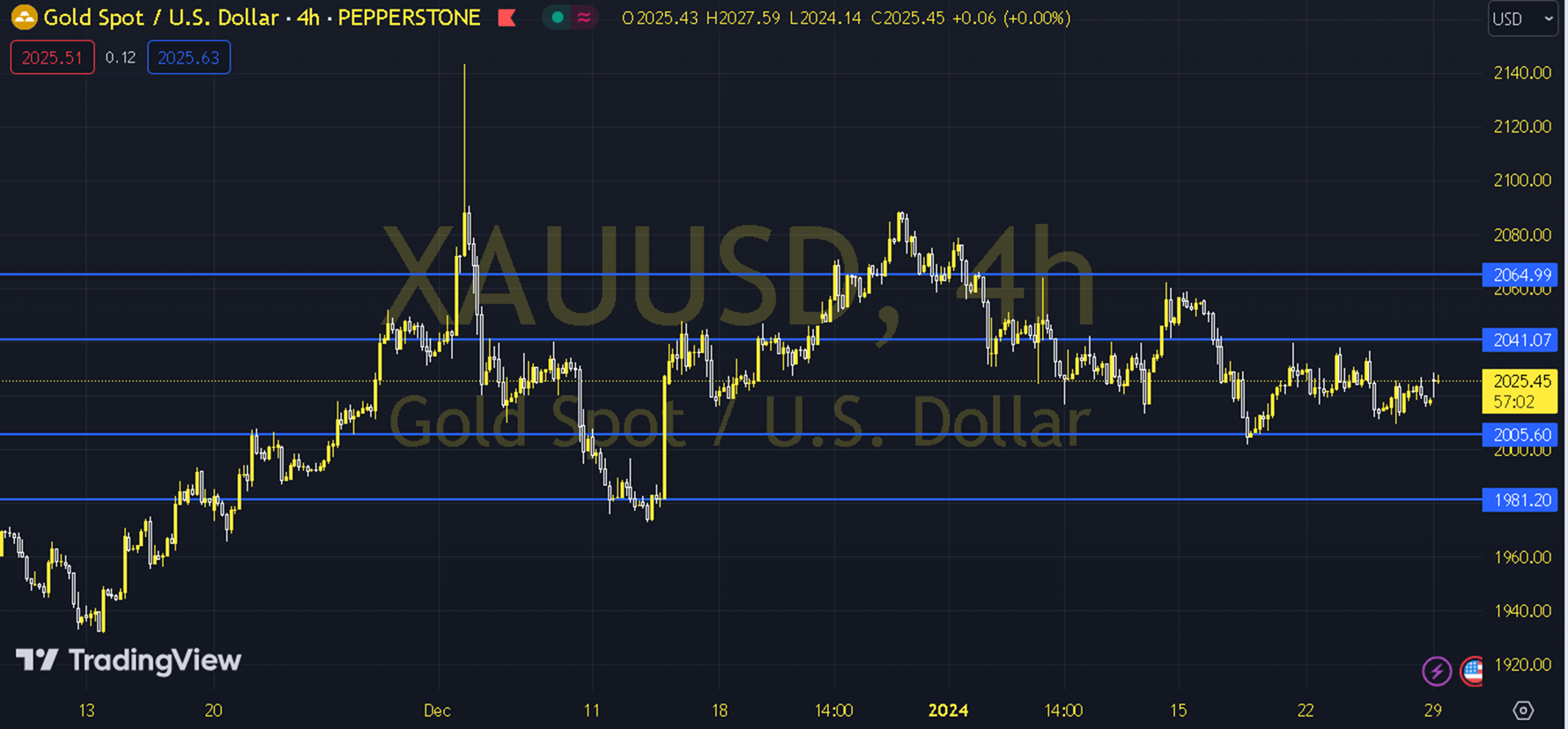

XAUUSD

On the first trading day of the week, ounce gold has recovered somewhat in the short term due to the pullback of the US 10-year Treasury bond yield to 4.13% and the increase in geopolitical risks in the Middle East. Technically speaking, we are following the 2021-2030 region, which is currently supported by the 34-day (2022) period exponential moving average. Permanent pricing above the 2030 level may be needed for the positive expectation to be reinforced. In possible recoveries, the 2040 and 2052 levels may come to the agenda. In order for the negative expectation to come to the fore, permanence below the 2012 level may be required. In possible declines, the 2012 and 2003 levels may be encountered. At this stage, the reaction of the 2003 level can be followed in order for the withdrawal trend to continue. Support: 2012-2003 Resistance: 2040-2052