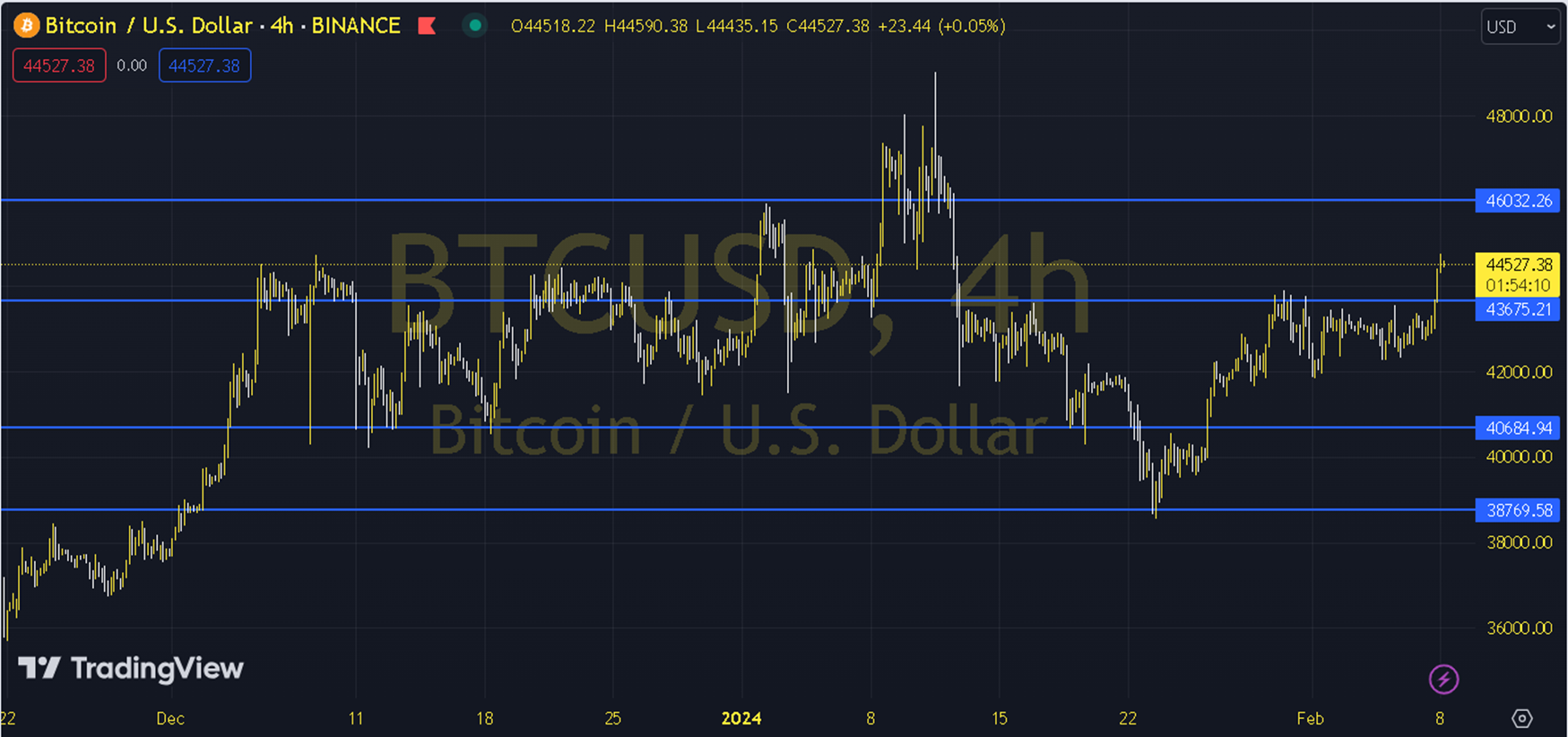

BTCUSD

Bitcoin At last week’s FOMC meeting, interest rates are expected to be higher than expected at the FOMC in May. Then, from April to May, the market will benefit from the dual benefits of the BTC halving and monetary policy changes. Since February, the decline in Grayscale holdings has slowed. Although Grayscale will eventually be traded due to high fees, BTC ETF funds in general are still showing slow inflows. Technically, Bitcoin, which is trading close to its 30-day average, has been floating around 44,500, and the market has reacted positively to it. If it breaks the 45,000 daily resistance, we could see a move to 47,000. If the sell-off increases, the 43,100 support is the strongest support, and if this support is broken, there is a potential drop to 40,800. Support: 43,100 Resistance: 45,000