BRENT

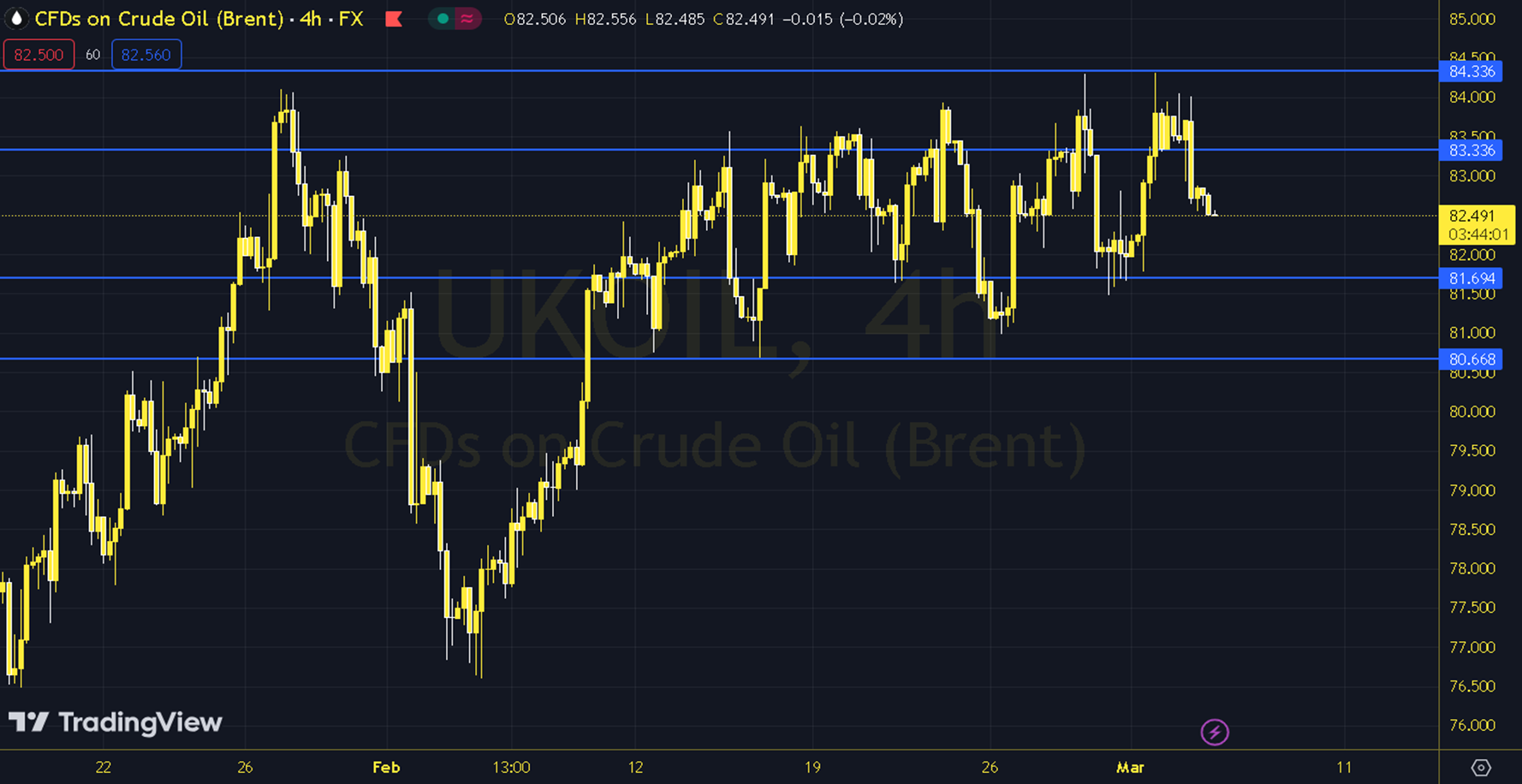

Oil futures contracts suffered losses as expectations of weakness in the global economy, especially in China, overshadowed the OPEC+ cutback decision. OPEC+ extended its production cutback policy until the end of June. Policymakers in China set the growth target for 2024 as 5%. This does not match the picture so far. However, incentives and the areas they will be directed to will be important. The course of European and US stock markets and the service PMI data in the US can be followed during the day. As long as pricing remains below the 83.00 resistance in the upcoming process, the downward outlook may be one step ahead. In possible declines, 82.00 and 81.50 levels can be targeted. As long as possible recoveries are limited by the 83.00 resistance, new downward potential may occur. Therefore, it may be necessary to see the course above 83.00 and hourly closings for the continuation of the upward desire. In this case, 83.50 and 84.00 levels may come to the agenda. Support: 82.00 – 81.50 Resistance: 83.00 – 83.50