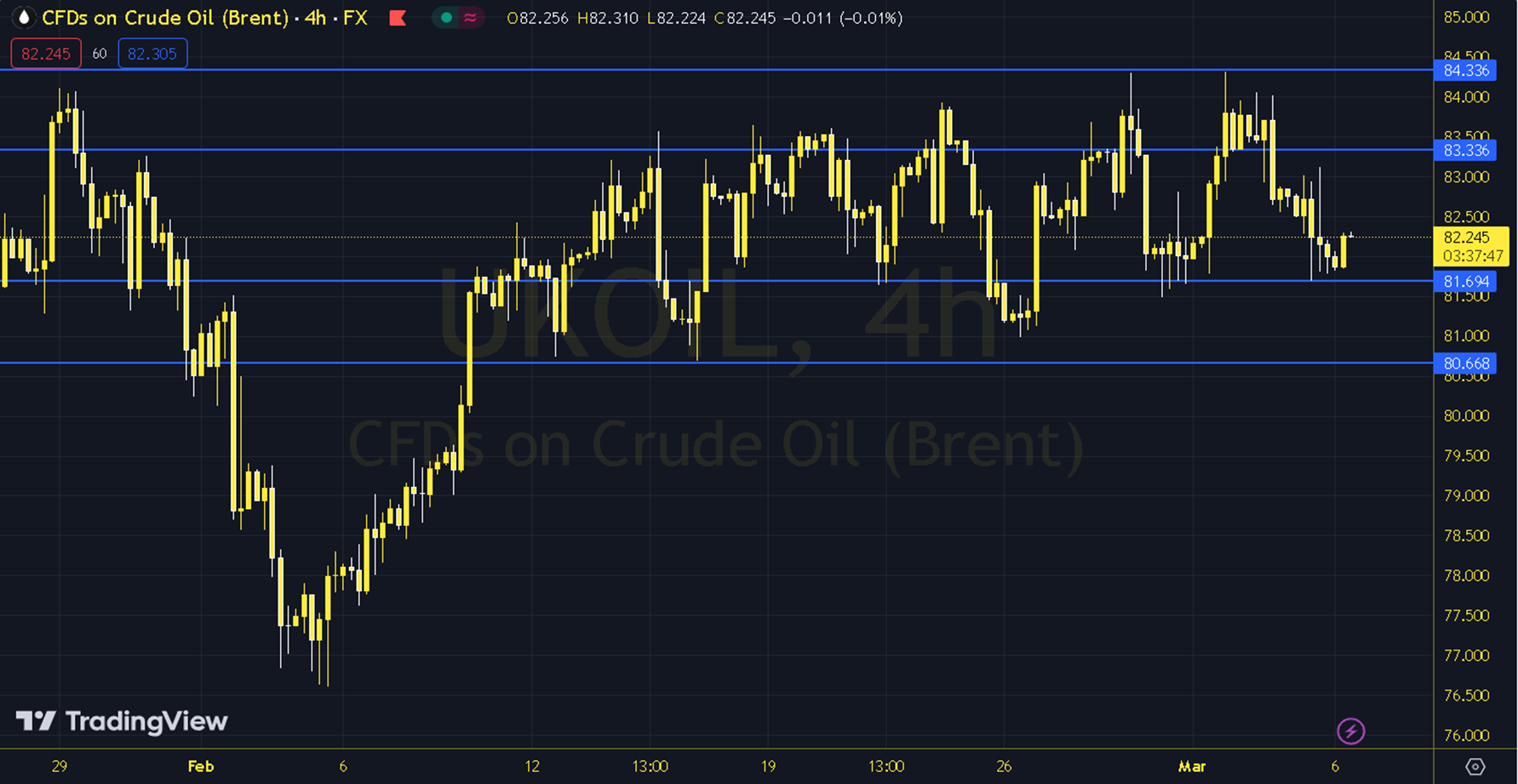

BRENT

Oil prices are following a calmer course after the OPEC+ decision to extend the cut and the movement created by the headlines of weakness in the global economy led by China. The American Petroleum Institute announced an increase of over 400 thousand barrels in stocks, creating some pressure on prices. Today, it will be watched whether the US Energy Information Administration will confirm this increase. As long as the pricing remains at and below the 82.00 - 82.50 resistance in the upcoming period, the downward trend may be one step ahead. In possible declines, 81.50 and 81.00 levels can be targeted. As long as possible recoveries are limited by the 82.00 - 82.50 resistance, new downward potential may occur. Therefore, it may be necessary to see the course above 82.50 and hourly closings for the continuation of the upward desire. In this case, 83.00 and 83.50 levels may come to the agenda. Support: 82.00 - 81.50 Resistance: 83.00 - 83.50