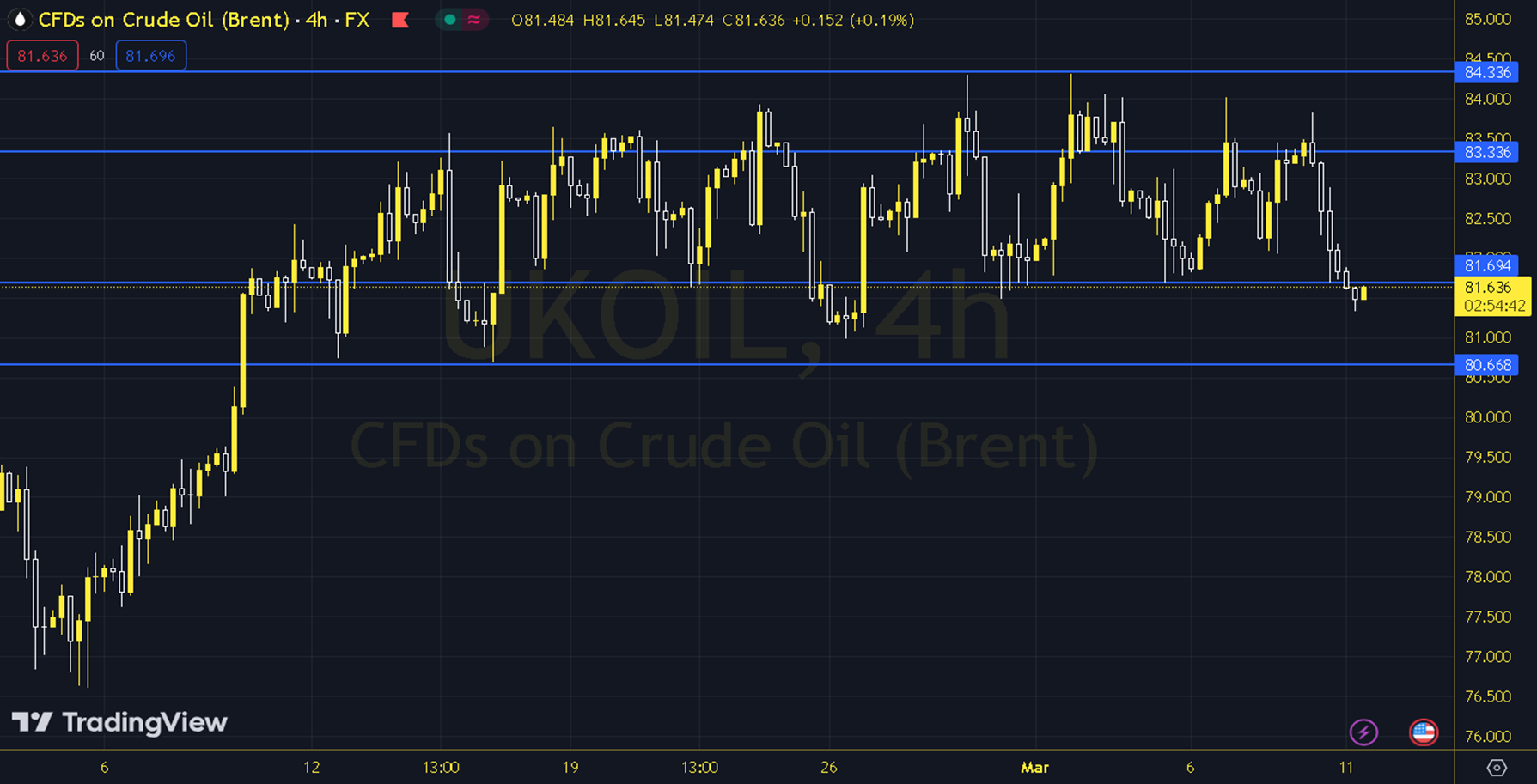

BRENT

Although oil prices have recently tried to recover due to the OPEC+ decision to extend the cut and geopolitical risks, concerns about global demand have limited the increases. The new week started with limited suppression. In addition to the inflation data to be announced in the US tomorrow, the stock figures to be announced in the US and the OPEC monthly report are among the headlines to be followed this week. As long as the pricing remains at and below the 82.00 - 82.50 resistance in the upcoming period, a downward outlook may be at the forefront. In possible declines, the 81.00 and 80.50 levels may be targeted. As long as possible recoveries are limited by the 82.00 - 82.50 resistance, new downward potential may occur. Therefore, it may be necessary to see the course above 82.50 and 4-hour closings for the continuation of the upward desire. In this case, the 83.00 and 83.50 levels may come to the agenda. Support: 81.00 - 80.50 Resistance: 82.00 - 82.50