XAUUSD

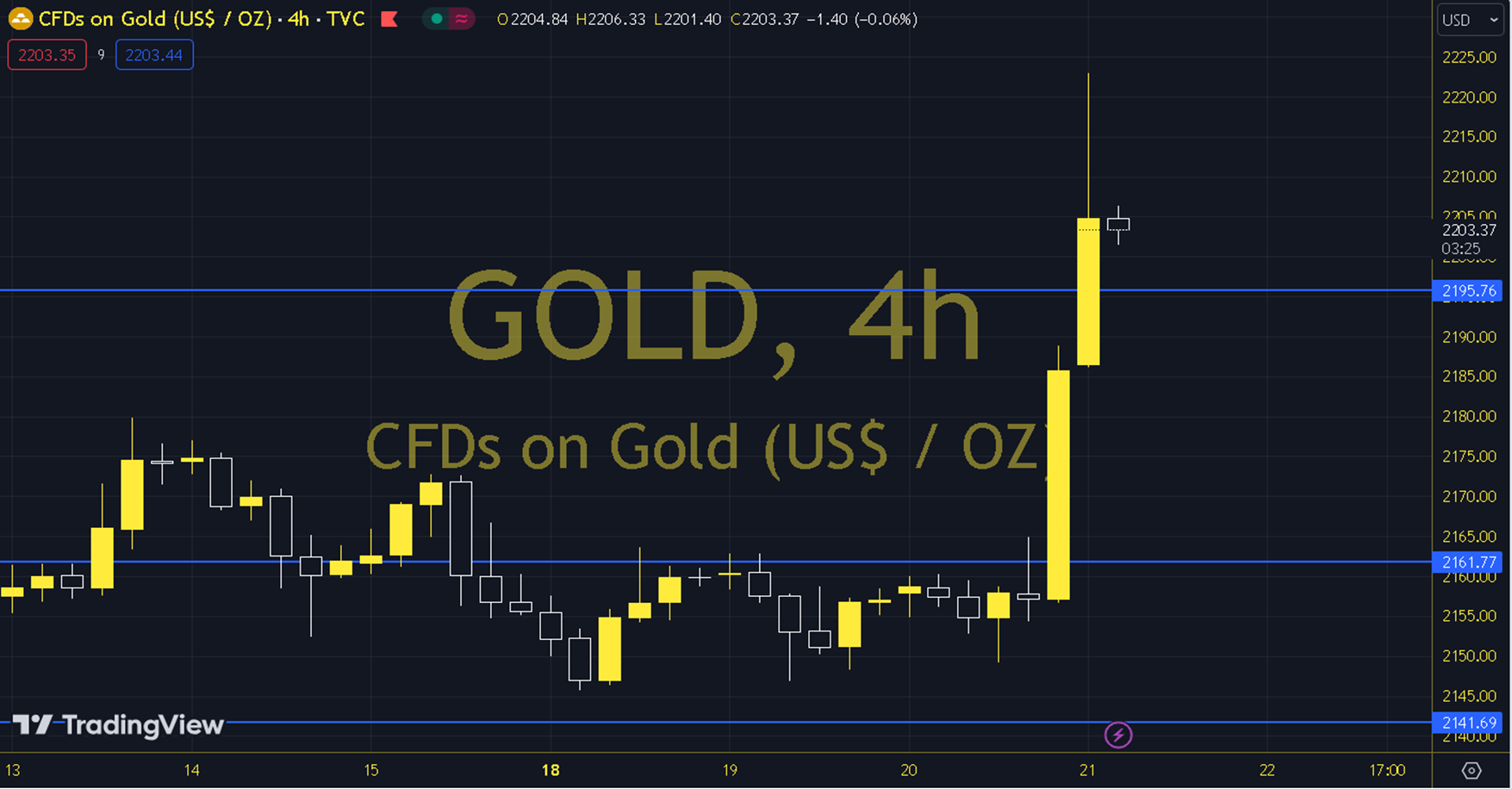

In the Fed monetary policy statement, after the policy rate was left unchanged, due to the effect of the 10-year Treasury bond yield being pulled back to 4.25%; in the short term, ounce gold displayed a record-breaking outlook (2222.5). Applications for unemployment benefits, Philadelphia Fed manufacturing index, leading service and manufacturing PMIs and existing home sales can be monitored during the day due to their possible effects. When we evaluate the short-term ounce gold pricing technically, we are monitoring the 2168 - 2175 region. The upward trend may continue as the precious metal moves above the 2168 - 2175 region. If the upward movements continue, the 2212 and 2223 levels may be encountered. In the meantime, the attitude of the 2223 level, which represents the historical peak, can be monitored in terms of the continuation of the positive expectation. In the alternative outlook, it may be necessary to see permanence below the 2168 - 2175 region for the negative expectation to come to the fore. In this case, pullbacks towards the levels of 2160 and 2150 can be observed. Support: 2175-2168 Resistance: 2212-2223