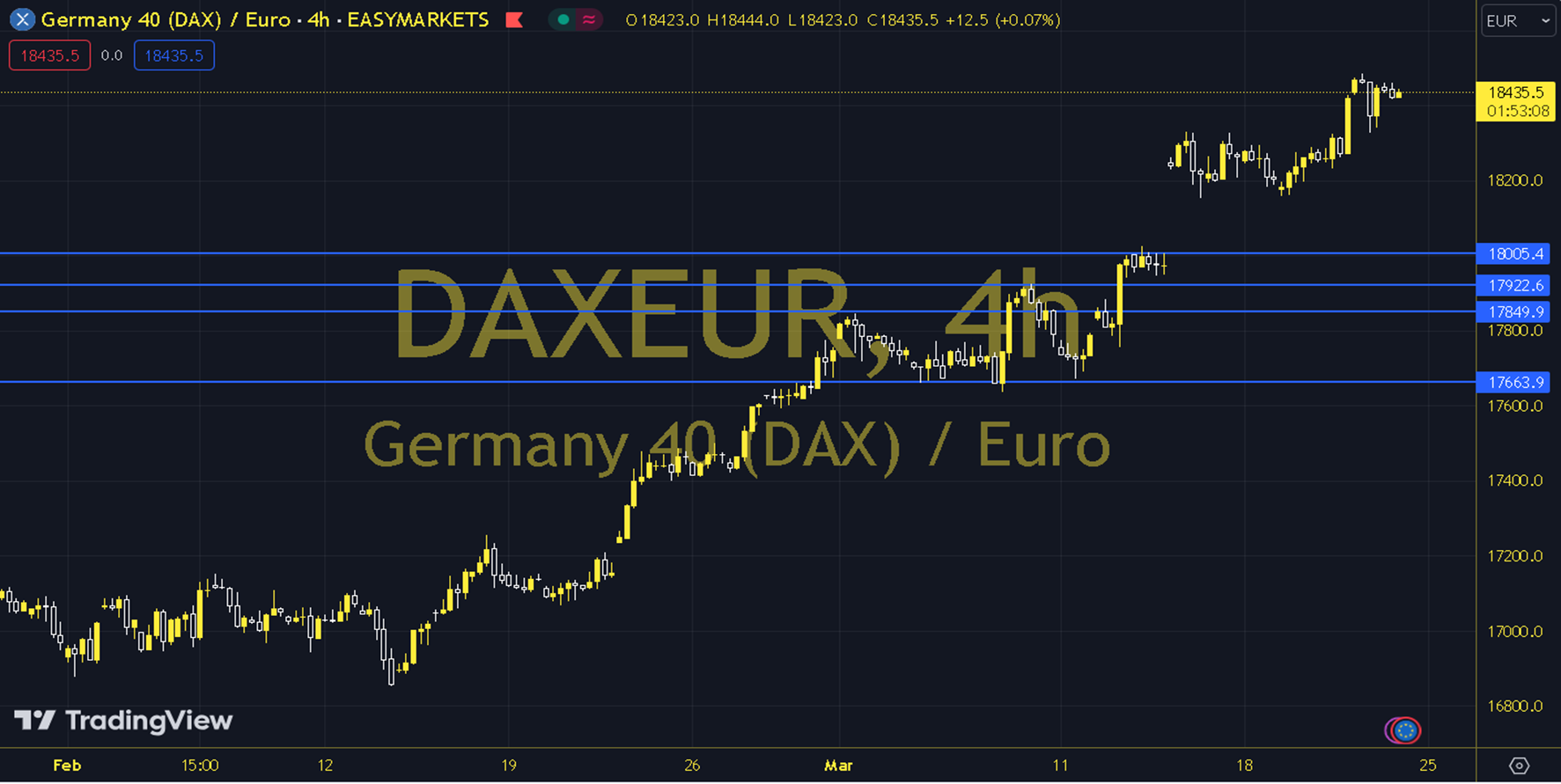

DAXEUR

The other day, after the interest rate decision of Switzerland, which was the first bank to take a loosening step among the global major central banks, European indices showed a positive trend. While the DAXEUR index gained 0.90%, today the IFO business climate data can be followed in terms of its impact on index movements. When we examine the short-term chart of the DAXEUR index technically, we are following the 18100 - 18200 region with support from the 20-period exponential moving average. As long as the index receives support from the 20-period average at 18200, positive expectations are at the forefront. In increases, increases towards the 18400 level can be seen with the 18300 resistance exceeded. If the index is suppressed under the 18300 resistance and cannot receive support from the 18000 level, negative expectations can come to the fore. In this case, downward deflections towards the 17800 level with support from the 89-period average can be followed. Support: 18100 – 18000 Resistance: 18300 – 18400