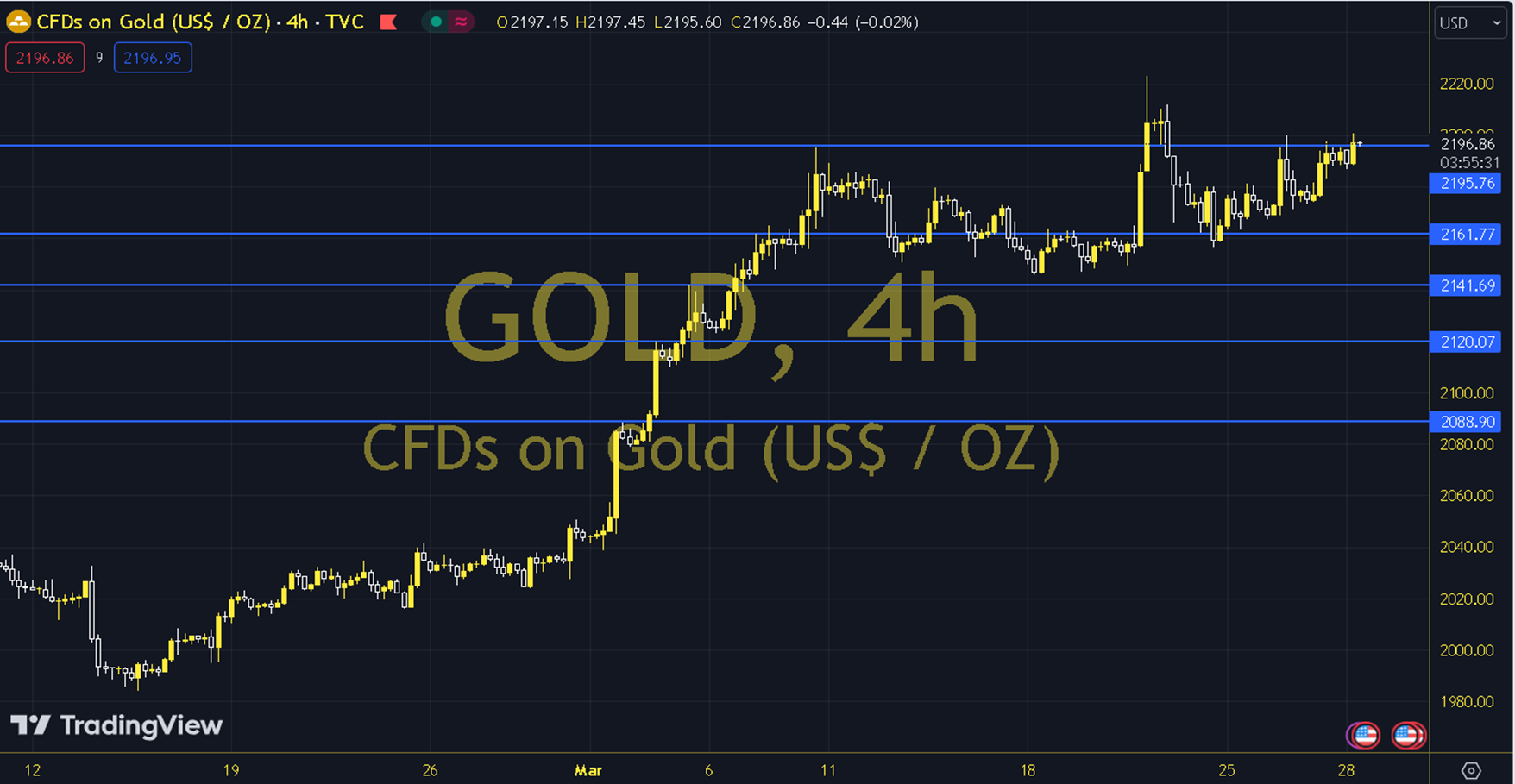

XAUUSD

With the support of the decline in the US 10-year Treasury bond yield towards 4.21%; ounce gold recorded upward pricing in the short term. During the day, growth rate and deflator, unemployment benefit applications, Chicago PMI, and Michigan consumer sentiment can be monitored due to their possible effects. When we evaluate the short-term ounce gold pricing technically, we are monitoring the 2175 - 2185 region, which is currently supported by the 13 (2185) and 34 (2178) period exponential moving average. As long as the precious metal limits the downward demand in the 2175 - 2185 region, the positive trend may continue. If the upward demand continues, a movement area may form towards the 2200 and 2212 levels. In the meantime, the attitude of the 2195 - 2200 range can be monitored in order for the upward expectation to continue. In the alternative view, in order for the downward trend to become dominant, permanent pricing below the 2175 - 2185 region may be needed. In this case, movements towards the 2168 and 2160 levels can be monitored. Support: 2185-2175 Resistance: 2200-2212