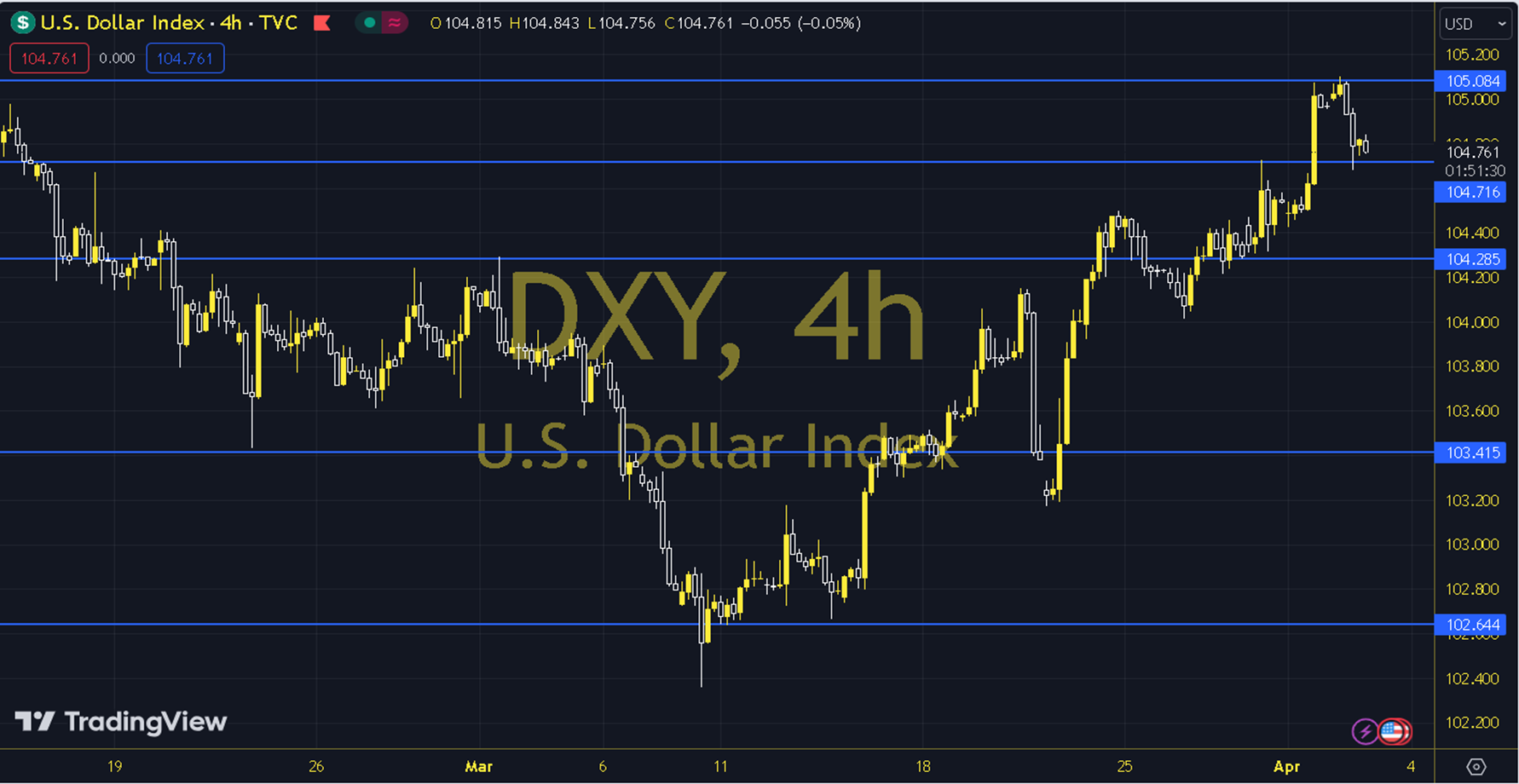

DXY

DXY pulled back a bit yesterday after the JOLTS data released in the US came in lower than expected. Markets will focus on the ADP Nonfarm Employment Change to be released today and the Nonfarm Employment data to be released on Friday. Unless there is a significant slowdown in US employment growth, the US Dollar is likely to continue trading stronger this week to reflect the risk that the Fed may lag behind European central banks in starting to cut interest rates. Technically, the 200-Day Moving Average range of 104.880-104.550 stands out as a support area in the short term. If this range is dropped, the pullback to the 50-Day Moving Average level of 103.970 may continue. On increases, the 100-Day Moving Average levels of 105.150-105.280 can be followed as resistance points. Support: 104,680-104,350 Resistance: 104,950-105,080