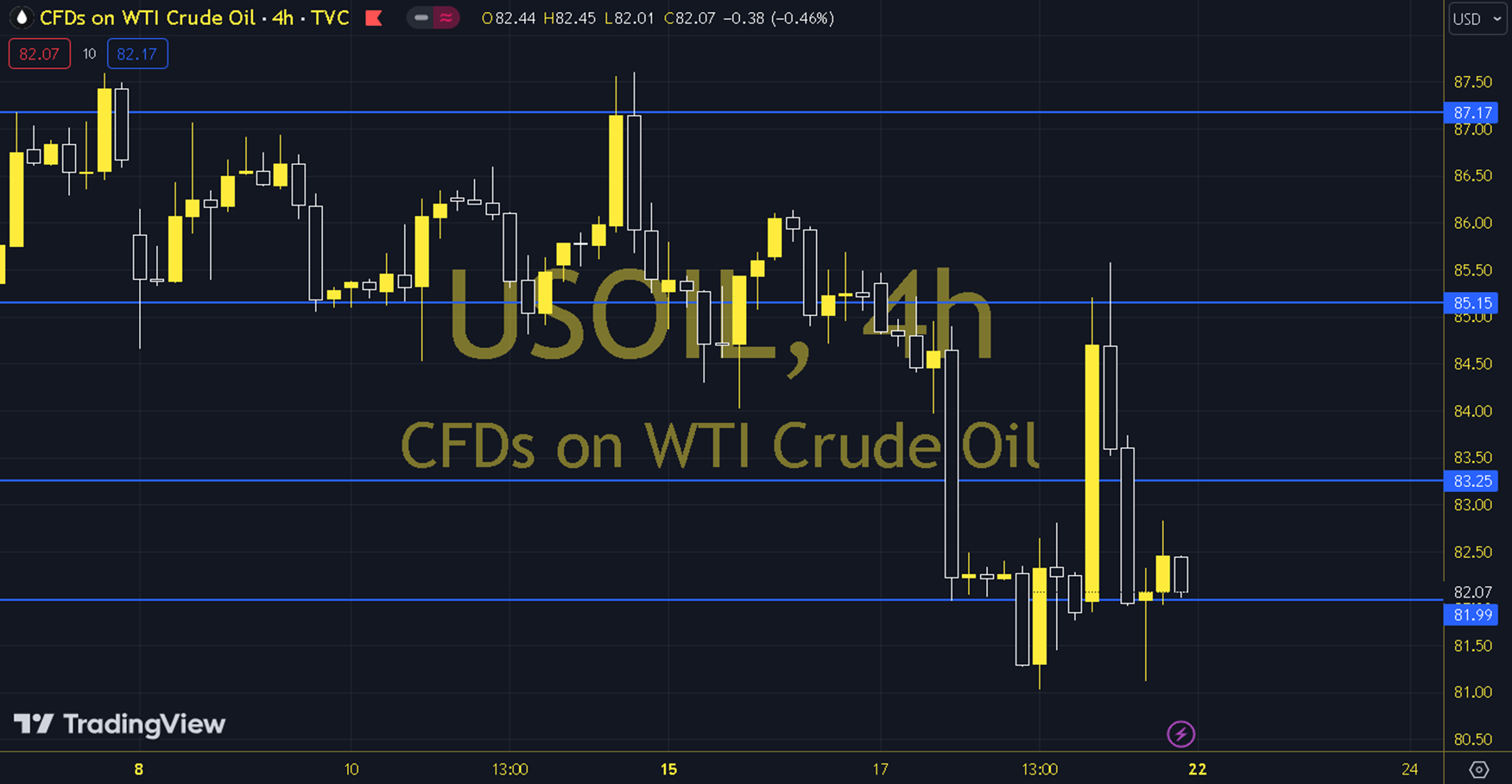

WTIUSD

Oil prices, which started the first quarter of the year with a steady increase, showed an effective pullback after the first few days of April. Although OPEC cuts are still seen as the driving force, the volatility that has increased with the recent tension in the Middle East is preventing a stable course for now. The US Senate approved a package that includes aid to Ukraine and Israel and potential sanctions on Iran's oil products. The course of European and US stock markets can be followed during the day. As long as the prices remain at and below the 82.00 - 82.50 resistance in the upcoming period, a downward trend may be at the forefront. An upward trend parallel to Brent oil dominates on the WTI side. WTI oil saw a high of 85.52 and a low of 81.11 on the previous trading day. The 82.90 level can be followed in intraday upward movements. If this level is exceeded, the 84.69, 87.31 and 89.11 resistances may become important. In case of possible pullbacks, 80.28, 78.49 and 75.87 will be monitored as support levels. Support: 80.28 – 78.49 Resistance: 84.69 – 87.31