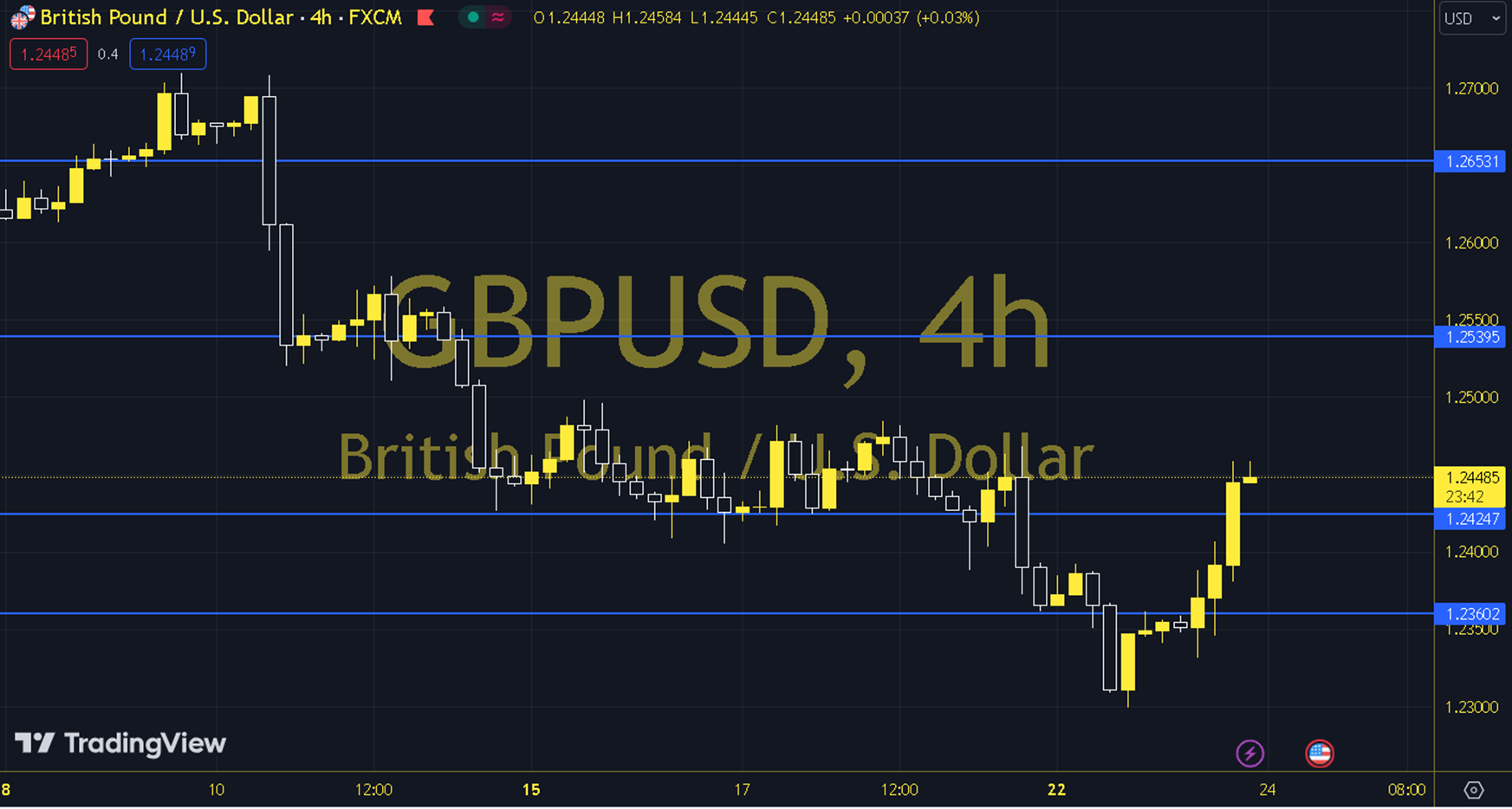

GBPUSD

Despite the Manufacturing PMI data in Europe that resulted below expectations, optimistic developments regarding the service sector drew attention, while the PMI data regarding the manufacturing sector in the US, in addition to its below-expected course, fell below the 50 threshold region and followed a negative course. Although the service sector remained in the growth region above the 50 threshold level, it provided a negative pricing in the Classic Dollar Index / positive pricing in EURUSD and GBPUSD parity with the below-expected result. When we come to the middle of the week, the results of the German IFO Business Climate Index and the US Core Durable Goods Orders data can be followed in the macroeconomic outlook. The 1.2455 level can be followed in intraday downward movements. If this level is dropped below, the supports of 1.2444, 1.2432 and 1.2421 may become important. In possible increases, 1.2466, 1.2477 and 1.2489 will be monitored as resistance levels. Support: 1.2444 – 1.2432 Resistance: 1.2466 – 1.2477