XAUUSD

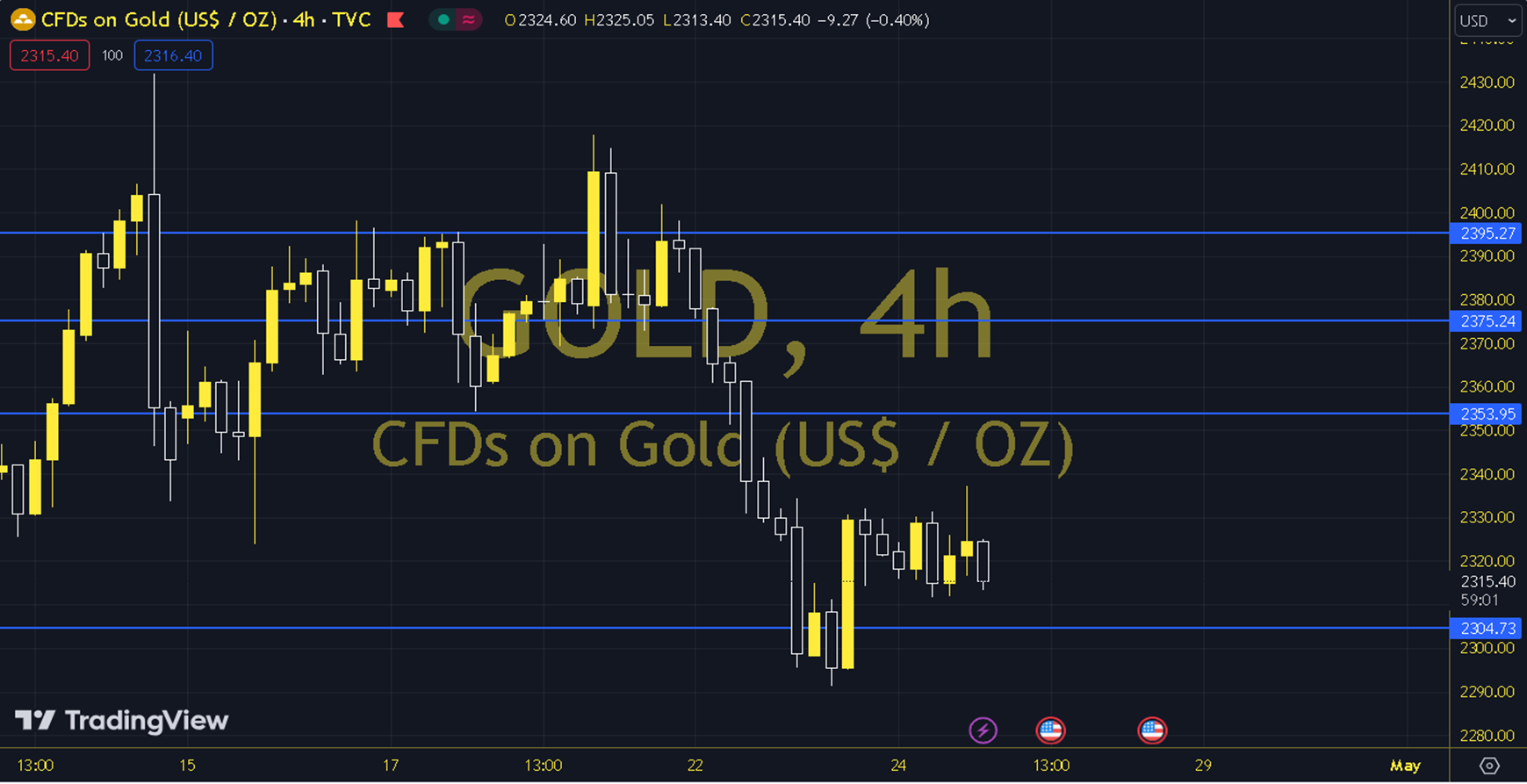

The US 10-year Treasury bond yield moving around 4.65% left room for a limited pullback in gold. The precious metal, which opened the day at 2315, is trading around 2312 while the analysis is being prepared. The growth rate and deflator, unemployment benefits applications and pending housing sales can be monitored during the day due to their possible effects. As long as it remains above 2,314, we can see upward momentum. The daily loss for gold, which closed at 2,315 on the previous trading day, was 0.03%. The upward movement observed in US bond yields is pressuring gold downward. The RSI indicator for gold, which is above its 20-day moving average, is at 55.13, while its momentum is at 98.43. The 2,314 level can be monitored in intraday downward movements. If this level is exceeded, the supports of 2,307, 2,299 and 2,292 may become important. In possible increases, 2,320, 2,330 and 2,338 will be monitored as resistance levels. Support: 2307 - 2299 Resistance: 2320 - 2330