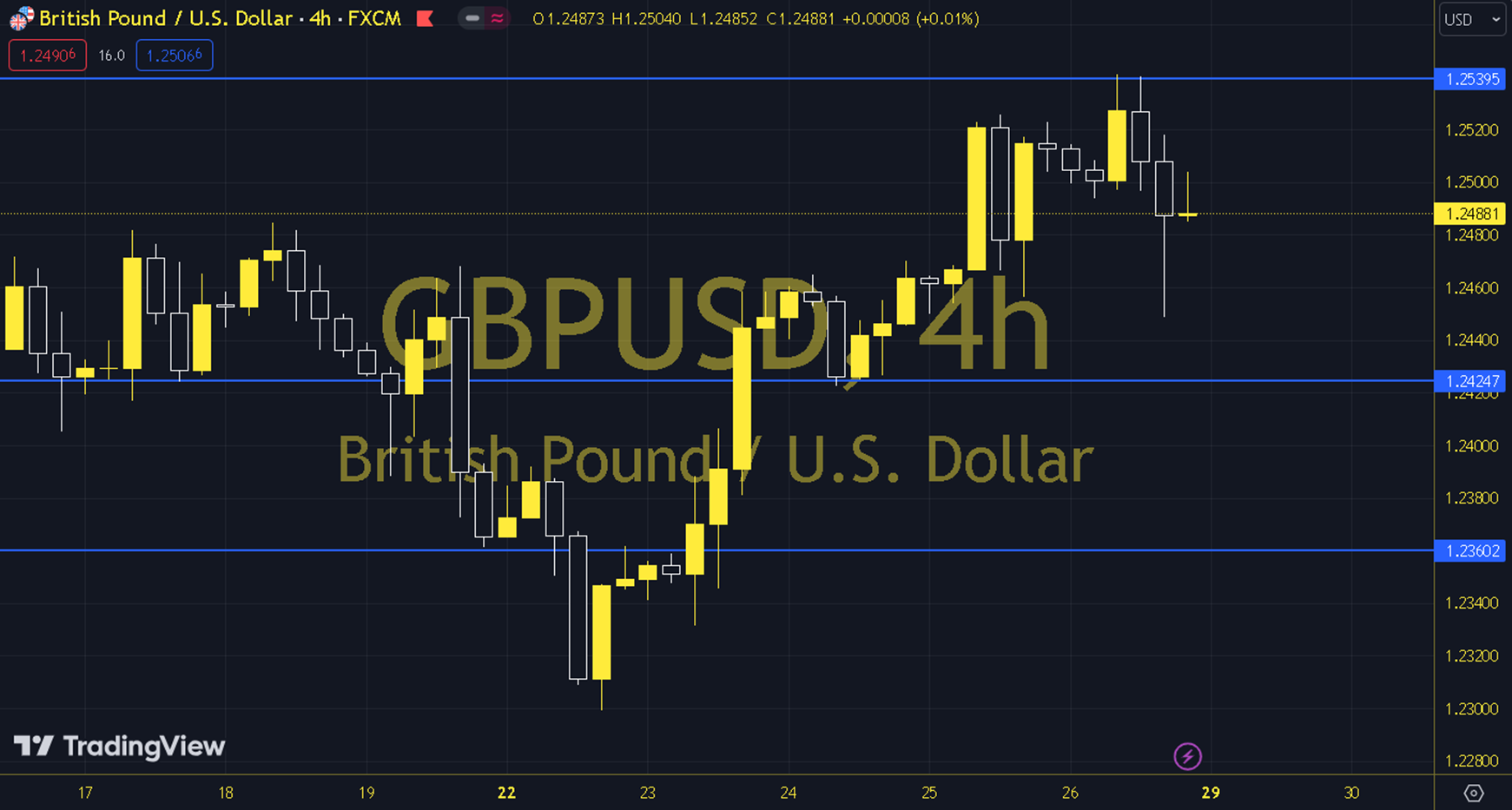

GBPUSD

In terms of the timing of interest rate cuts by major central banks, it is expected that the ECB will take action in the June meeting, the BoE in the August meeting, and the Fed in the September meeting. In particular, the US Federal Reserve Fed's postponement of the timing brings interest rate cuts by other major banks to the forefront, while this situation is a development that supports the medium-term increases in GBPUSD parities from the Euro and Sterling to the US Dollar. In the new week's dynamics, whether the Fed will support the postponement of the interest rate cut, especially in light of recent developments, is important in order to interpret the course of the index and parities. The 1.2523 level can be monitored in intraday downward movements. If this level is dropped below, the supports at 1.2506, 1.2474 and 1.2457 may become important. In possible increases, 1.2555, 1.2573 and 1.2604 will be monitored as resistance levels. Support: 1.2506 – 1.2474 Resistance: 1.2555 – 1.2573