DXY

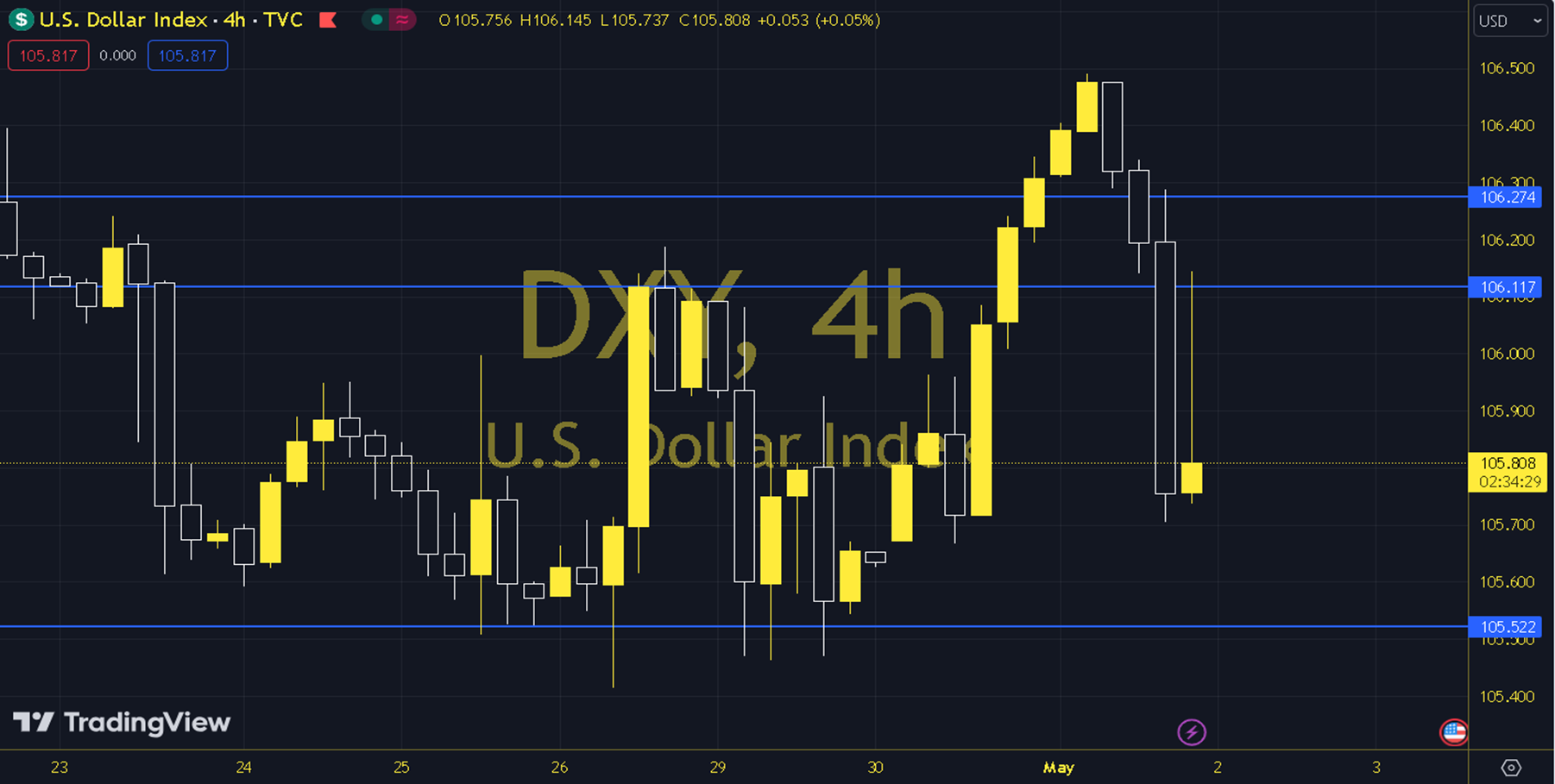

We have left the most important development of the week (Fed) behind. The reaction of the Classic Dollar Index limited the declines in the pairs. Despite the reaction (decline) observed on the index front, optimism continues on the 34 and 100-day averages (104.14 - 104.94 region). In this respect, the expectation of reaching the 107 level tested in October 2023 and the idea of a strong dollar remains on the table. After the Fed, our main focus will be on Friday's Nonfarm Payrolls and Average Hourly Earnings data. Today, Manufacturing PMI from Germany and Unemployment Claims from the US may be on our radar. The 105,600 level can be followed in intraday downward movements. If this level is dropped, the 105,340 support may become important. In possible increases, 105,880 and 106,000 will be monitored as resistance levels. Support: 105,600-105,340 Resistance: 105,880-106,000