WTIUSD

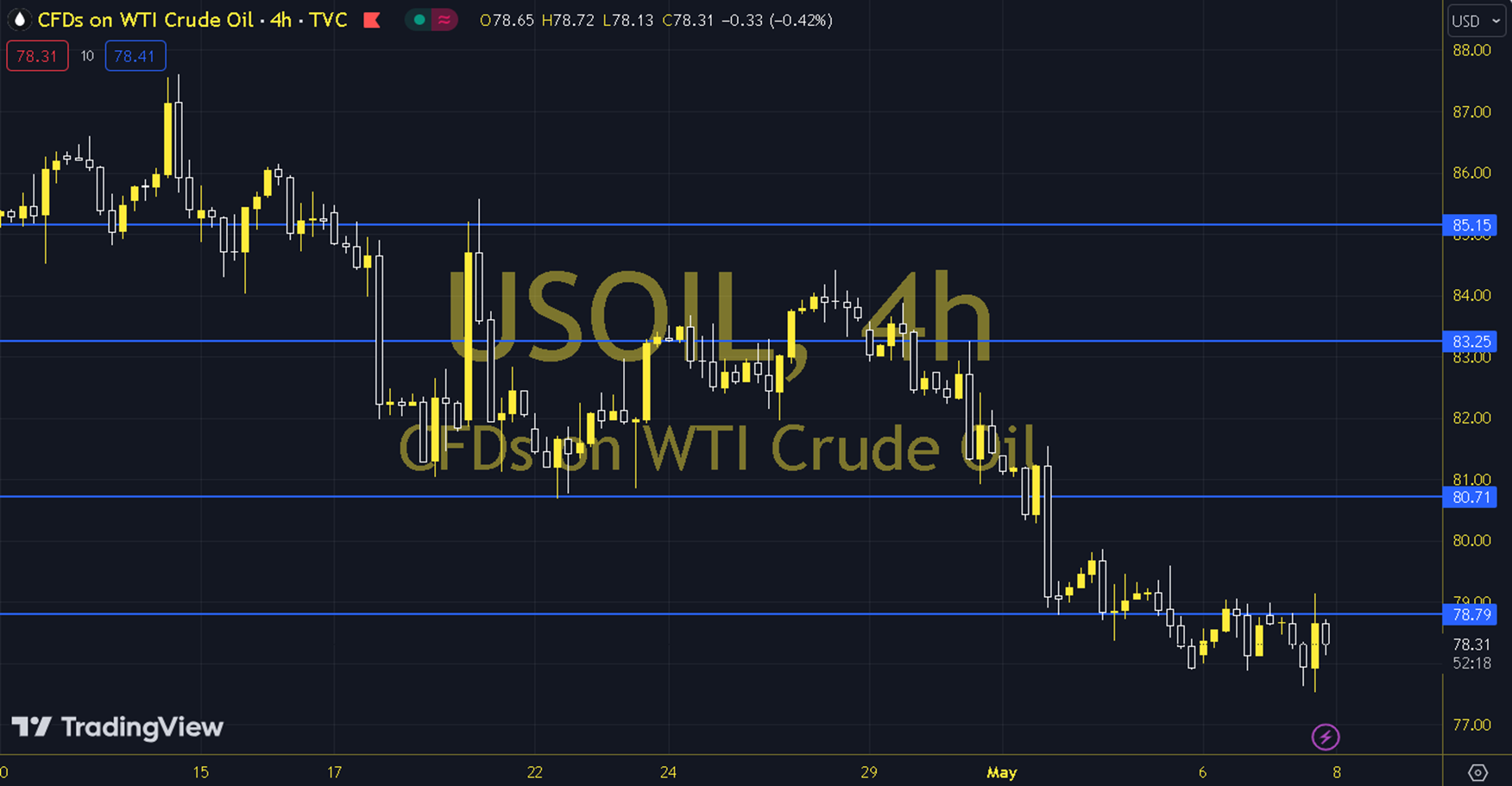

Oil futures contracts maintained their under-pressure outlook while evaluating stock figures and monitoring the Middle East agenda. While the American Petroleum Institute announced an increase of approximately 500 thousand barrels in stocks, the data to be announced by the US Energy Information Administration today will be monitored. On the other hand, Israel entered Rafah and the process is being closely monitored. As long as the pricing remains below the 78.50 - 79.00 resistance supported by the 13 and 20-period exponential moving averages during the day, a downward trend may be at the forefront. In possible declines, the 77.50 and 77.00 levels may be targeted. On the WTI side, a downward trend parallel to Brent oil is also dominant. WTI oil saw a high of 78.88 and a low of 77.39 on the previous trading day. The 78.12 level can be followed in intraday upward movements. If this level is exceeded, the 78.85, 79.61 and 80.34 resistances may become important. In case of possible pullbacks, 77.36, 76.63 and 75.87 will be monitored as support levels. Support: 77.36 – 76.63 Resistance: 78.85 – 79.61