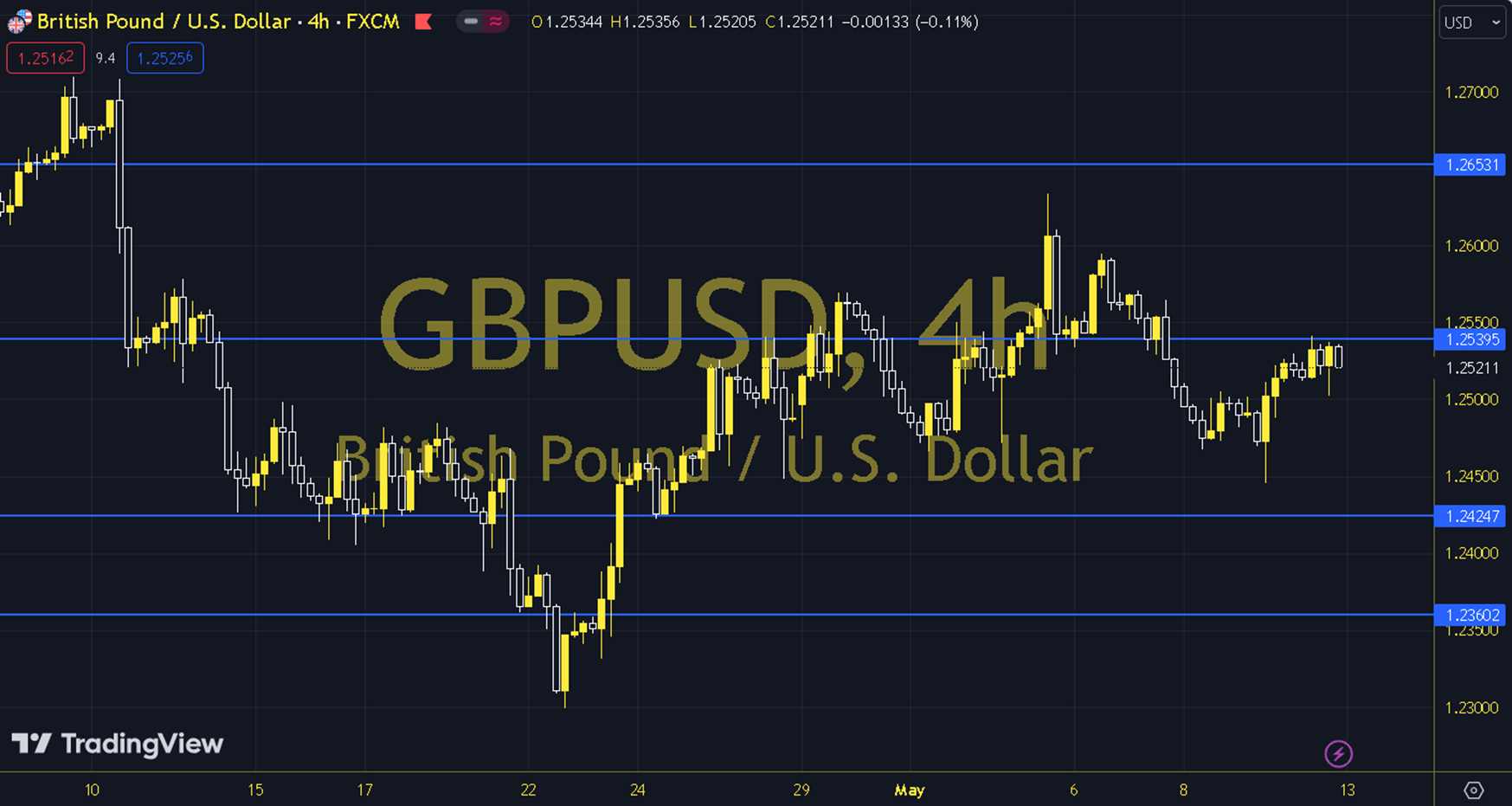

GBPUSD

On the first trading day of the week, we watched the Classic Dollar Index struggle to stay above its 34-day average. Recently, both the index and the parities (EURUSD and GBPUSD) have been in a certain fluctuation trend. Although there has been no significant change in their medium-long term outlooks, short-term movements can create differences in instant reactions. At this stage, the US CPI data, which we will reach in the middle of the week, may cause sharp changes in the index and parities. We will follow the data result and the Fed interest rate cut timing condition in terms of whether this change will support the trend view. When we return to today, the employment market data from the UK and inflation (PPI) data from the US and the Fed Chairman Powell speech attract attention. The 1.2557 level can be followed in intraday upward movements. If this level is exceeded, the 1.2562, 1.2568 and 1.2573 resistances may become important. In case of possible pullbacks, 1.2546, 1.2540 and 1.2532 will be monitored as support levels. Support: 1.2540 – 1.2532 Resistance: 1.2562 – 1.2568