DXY

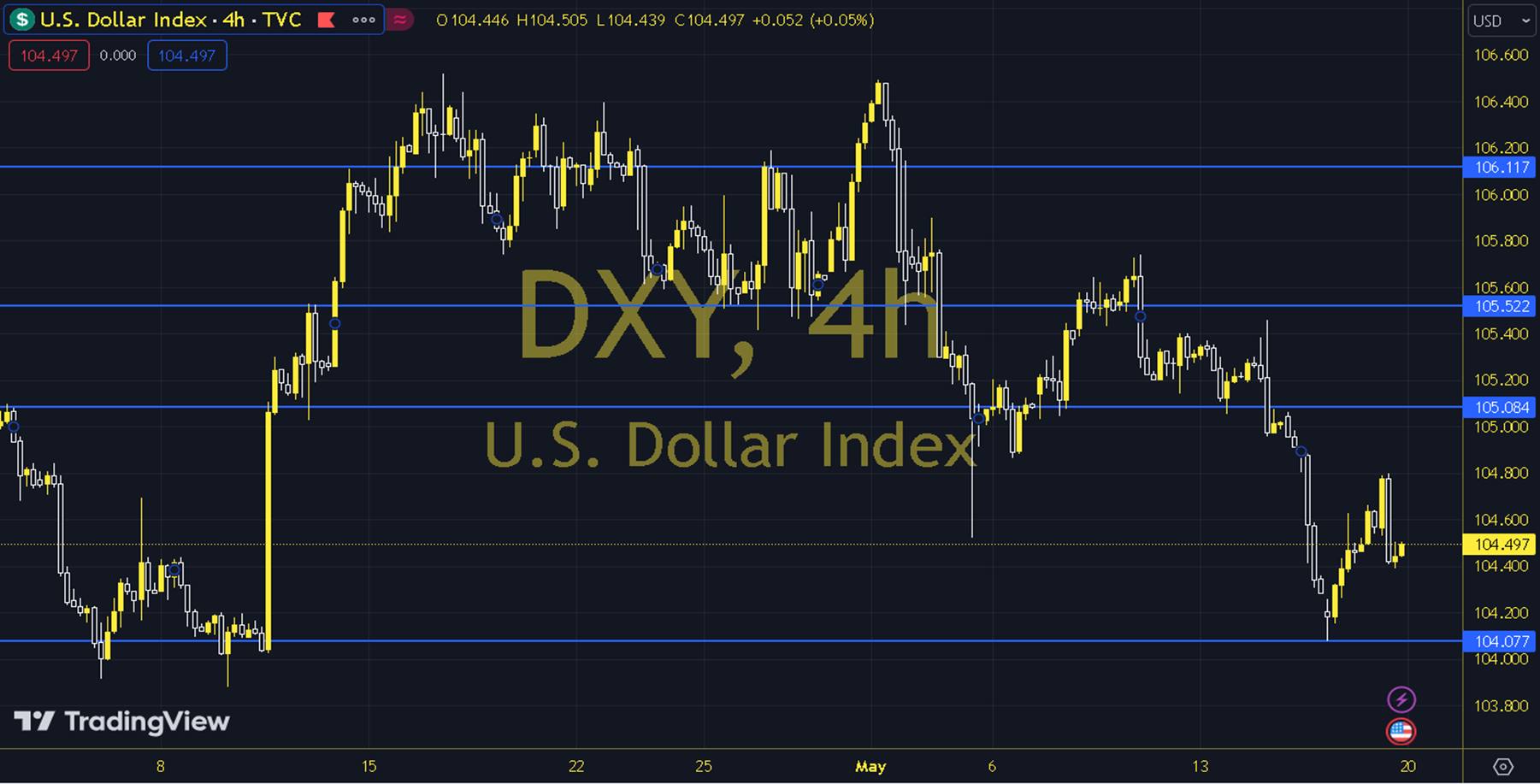

The Classic Dollar Index has attracted attention with its negative pricing behavior in the recent process. The index's performance this week should be followed carefully in a process that allows us to question whether the positive trend appearance has ended by falling below the 34 and 100-day EMA. The general strategy can be explained as the confirmation of the uptrend with persistence above the 34-day average (104.85), and the end of the uptrend with persistence below the trend bottom point (103.90). The PMI data, primarily, as well as the speech of FOMC members (Bostic, Barr, Waller, Jefferson, Mester, Barkin, Williams), US Treasury Secretary, ECB President Lagarde and BoE President Bailey, and the minutes of the FOMC meeting on May 1 can be explained as the most followed developments of the week. The 104.260 level can be followed in intraday downward movements. In case of falling below this level, the support of 104.110 may become important. In possible increases, 104,780 and 104,950 will be monitored as resistance levels. Support: 104,260-104,110 Resistance: 104,780-104,950