BRENT

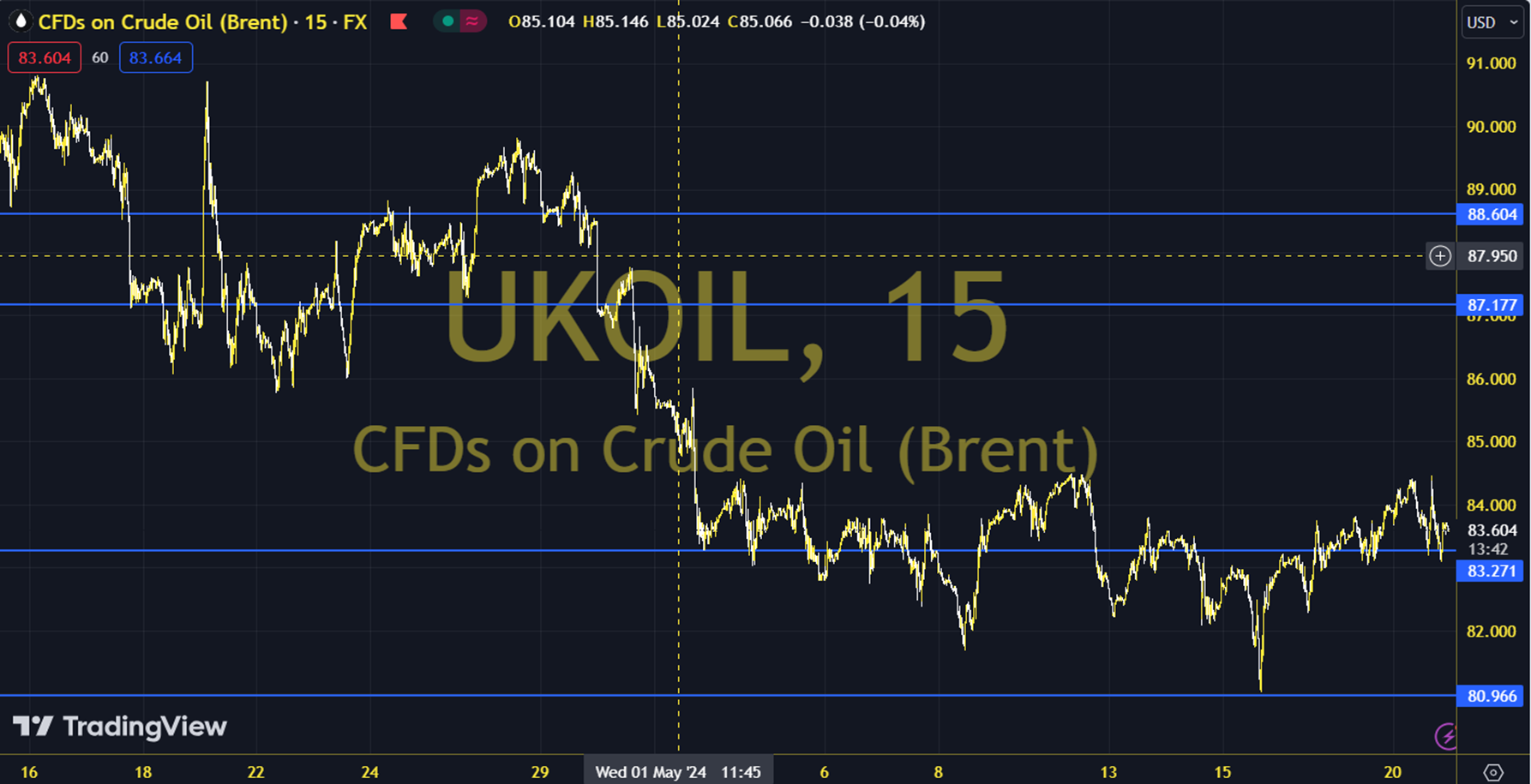

Oil futures contracts showed a downward trend despite headlines that raised geopolitical risk perceptions over the weekend. The weak demand outlook is making its impact felt ahead of the OPEC meeting to be held in early June. The course of European and US stock markets, Fed officials' speeches and the stock figures to be announced by the American Petroleum Institute can be followed during the day. Brent oil, which followed a buying course on the last trading day, gained 0.58% daily. The RSI indicator for the commodity, which is below its 20-day moving average, is at 41.38, while its momentum is at 96.80. The 82.89 level can be followed in intraday downward movements. If this level is dropped below, supports at 82.31, 81.47 and 80.89 may become important. In possible increases, resistance levels at 83.74, 84.32 and 85.16 will be monitored. Support: 82.89 - 82.31 Resistance: 83.74 - 84.32