DXY

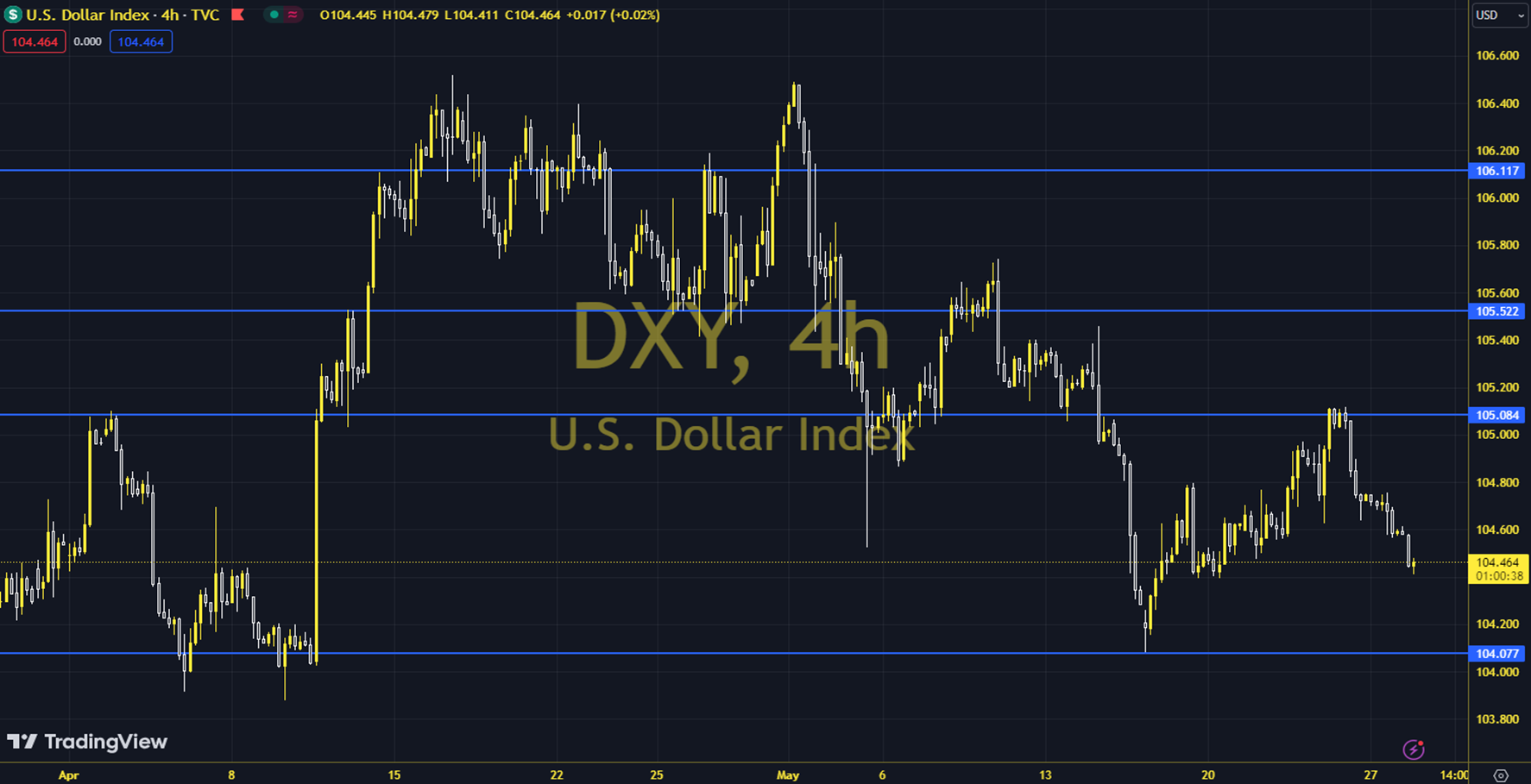

The Classic Dollar Index is trying to decide whether to continue its upward trend due to its course between 105.00 - 103.90 and its approach to the 103.90 level with the recent declines. The possible permanent movements of the index outside the relevant region in this process are also very important in order to interpret the short-term roadmap of the EURUSD and GBPUSD parity. Above 105.00, it can be explained as positive trend continuity, below 1039.90, it can be explained as trend change. Today, the Conference Board (CB) Consumer Confidence and FOMC members' speeches can be explained as intraday developments. The 104.280 level can be followed in intraday downward movements. If this level is broken, the support levels of 104,060, 103,810 and 103,590 may become important. In case of possible increases, the resistance levels of 104,680, 104,910 and 105,070 will be monitored. Support: 104,280-104,060 Resistance: 104,680-104,910