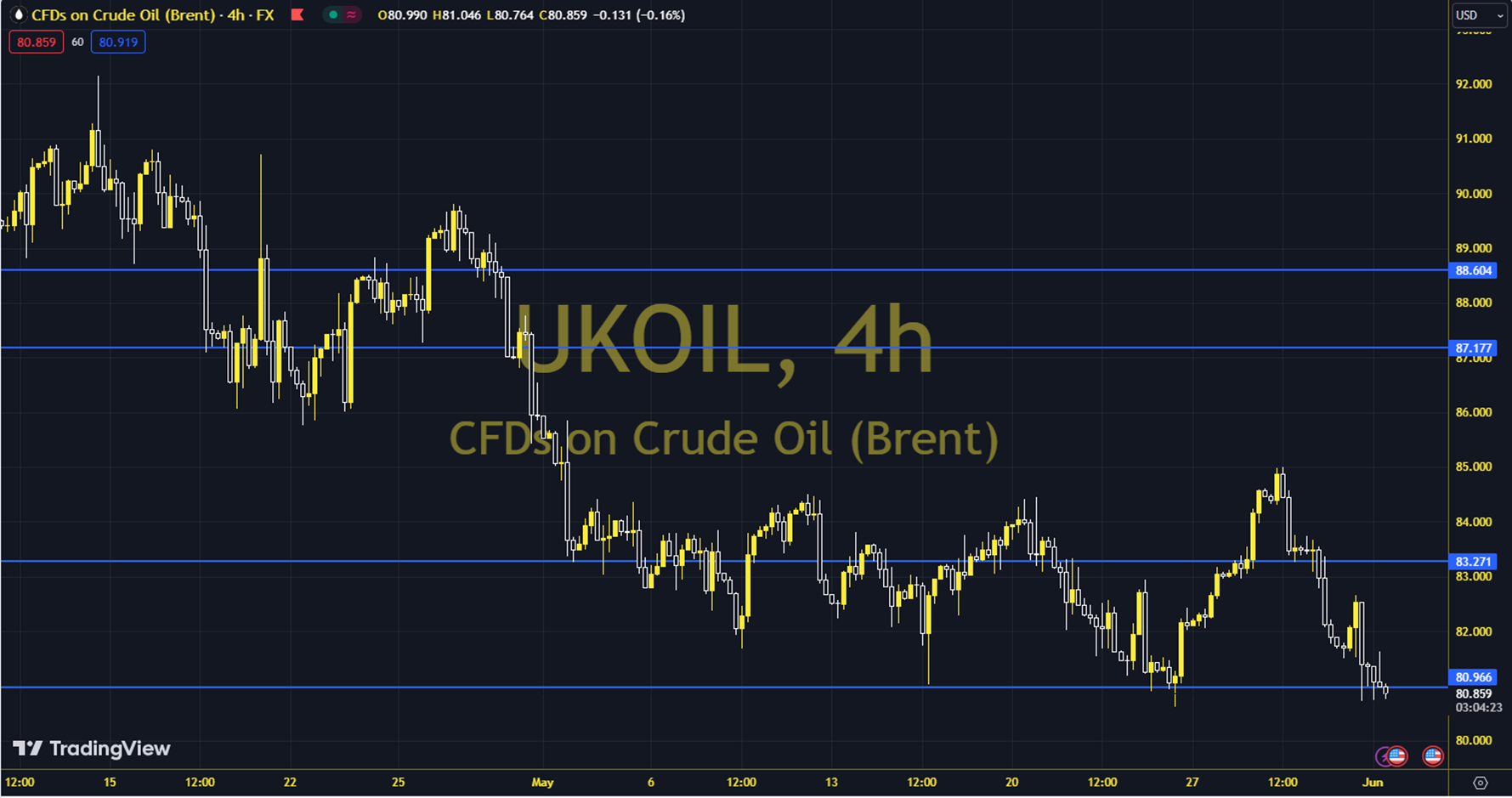

BRENT

OPEC+ statements were effective in oil futures starting the week with losses. The organization announced that production cuts will continue in the third quarter and that the cuts will be gradually lifted over the next 12 months. The course of European and US stock markets can be followed during the day. In general, a downward trend is seen. Brent oil saw a high of 82.64 and a low of 80.72 on the previous trading day. Brent oil, which followed a selling trend on the last trading day, lost 0.66% daily. The RSI indicator for the commodity, which is below its 20-day moving average, is at 39.65, while its momentum is at 98.38. The 81.57 level can be followed in intraday upward movements. If this level is exceeded, the resistances of 82.41, 83.49 and 84.34 may become important. In possible pullbacks, 80.49, 79.65 and 78.57 will be monitored as support levels. Support: 80.49 – 79.65 Resistance: 81.57 – 82.41