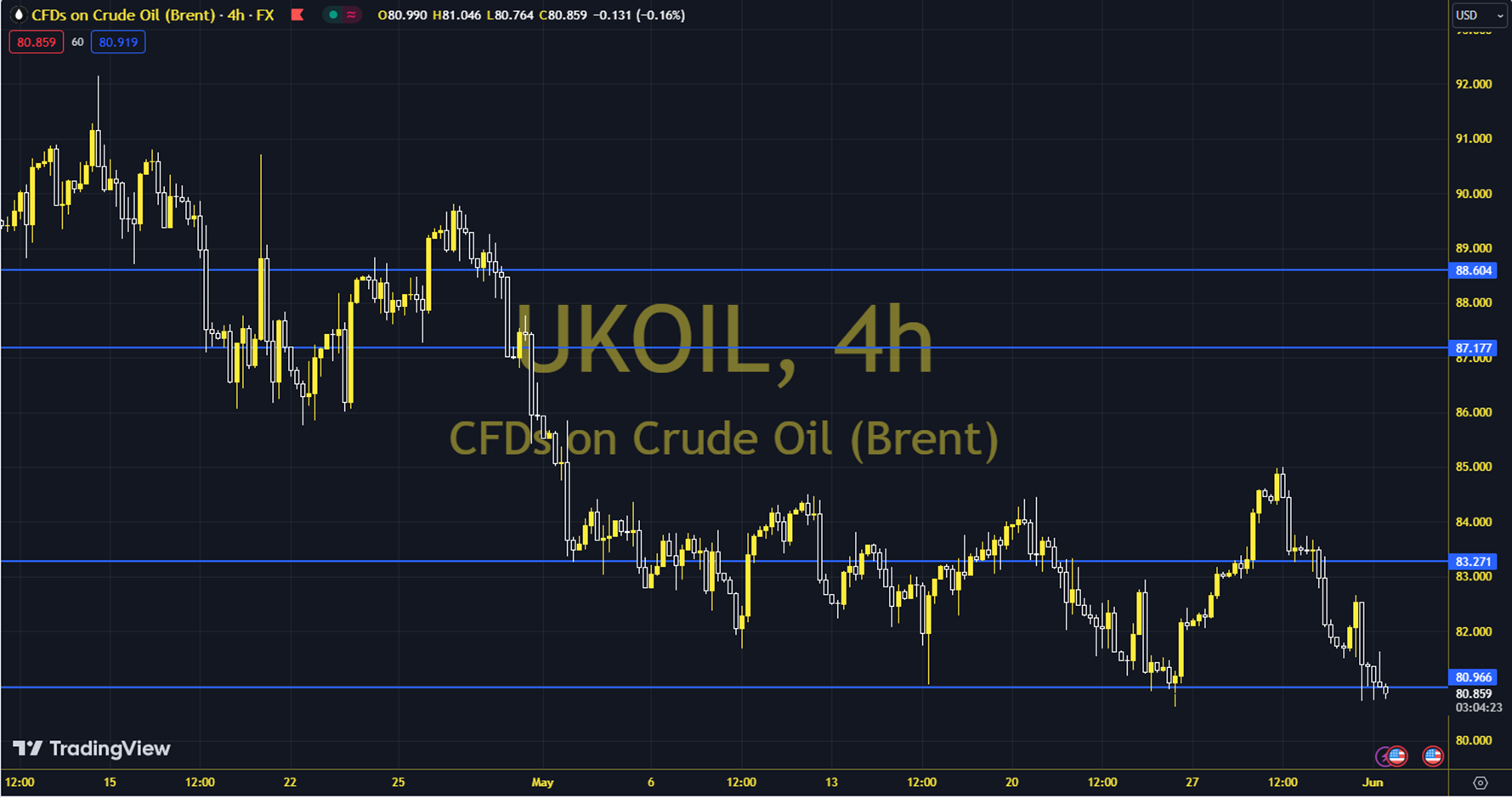

BRENT

Despite the pessimistic outlook on demand, oil futures have made some recovery since yesterday evening. While the US Energy Information Administration announced a 1.2 million barrel increase in stocks, Saudi Arabia's lowering of sales prices to the Asian market supported concerns about demand. The course of European and US stock markets can be followed during the day. In general, a downward trend is seen. Brent oil saw a high of 78.48 and a low of 77.11 on the previous trading day. Brent oil, which followed a buying course on the last trading day, gained 1.74% daily. The RSI indicator for the commodity, which is below its 20-day moving average, is at 34.98, while its momentum is at 94.00. The 78.02 level can be followed in intraday downward movements. If this level is broken, supports at 77.56, 76.65 and 76.19 may become important. In possible increases, resistance levels at 78.94, 79.39 and 80.31 will be monitored. Support: 78.02 – 77.56 Resistance: 78.94 – 79.39