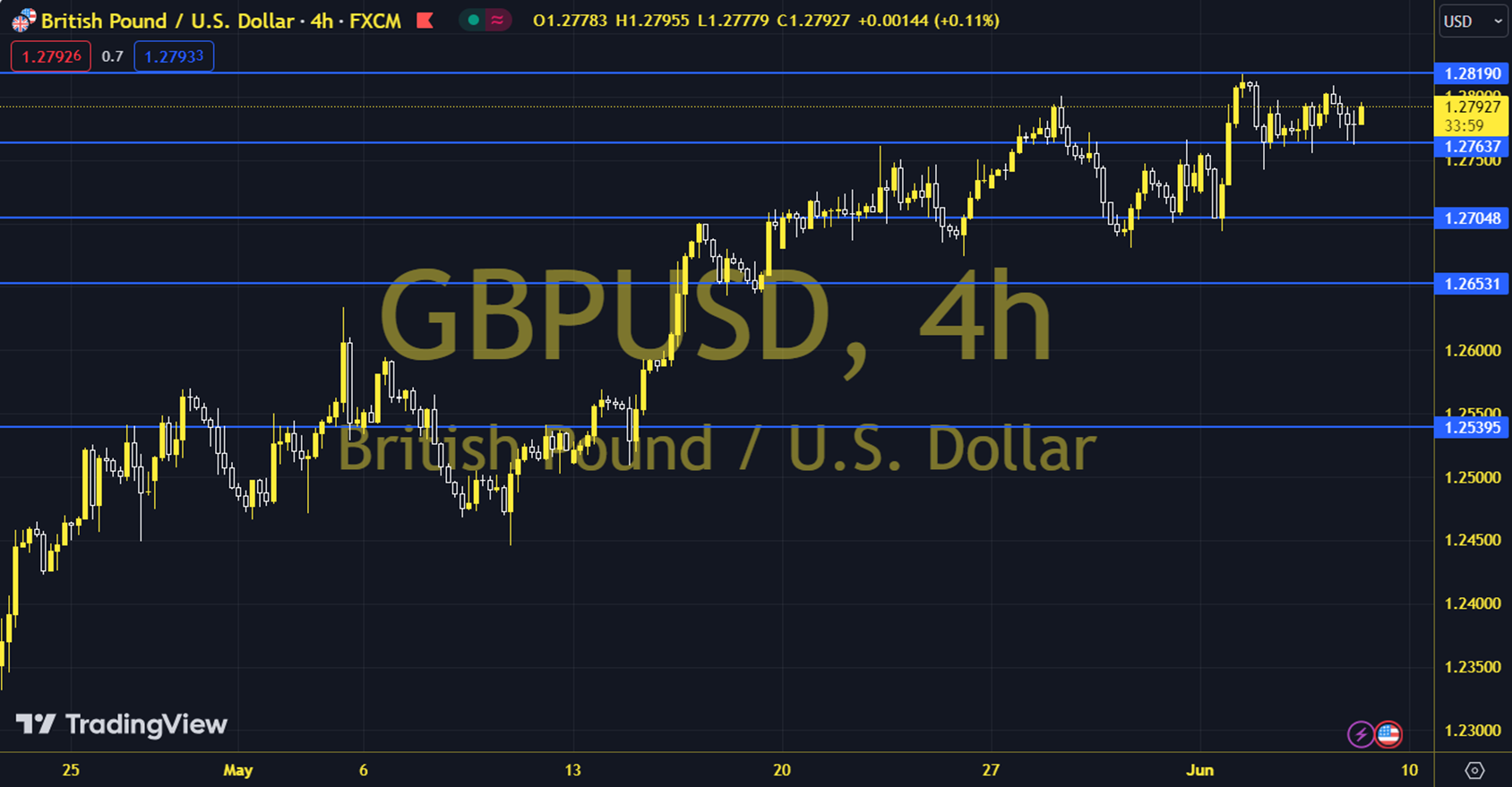

GBPUSD

The CPI for May, followed by the Fed Interest Rate Decision, FOMC Economic Projections and Fed Chair Powell's speech were announced as the most important developments of the week in the middle of the week, while the Classic Dollar Index did not react above 105.05, which limited the declines in the EURUSD parity. On the other hand, despite the short-term declines in the GBPUSD, the absence of very sharp differences on the BoE front and the postponement of the interest rate cut timing together with the latest CPI data ensure that the Sterling remains strong. While it is expected that the critical developments in the middle of the week will affect most asset prices from A to Z, we can say that the second trading day of the week will be a calm data day except for the news flow regarding the UK employment market. The 1.2722 level can be followed in intraday downward movements. If this level is dropped, the supports of 1.2708 and 1.2699 may become important. In possible increases, 1.2746, 1.2755 and 1.2769 will be followed as resistance levels. Support: 1.2722 – 1.2708 Resistance: 1.2746 – 1.2755