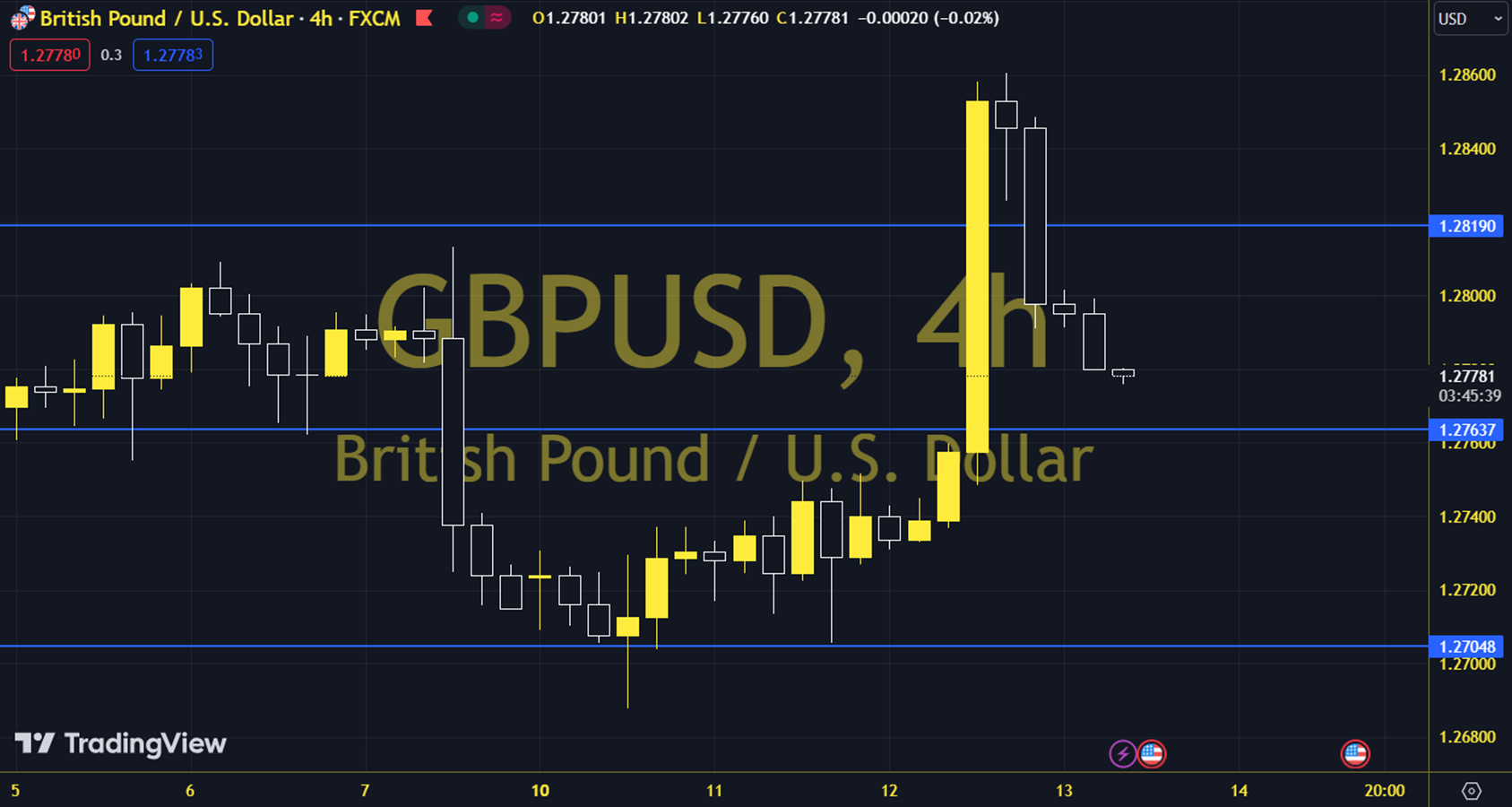

GBPUSD

The happiness observed in the markets with the expected US CPI data could not continue completely with the Fed decisions. In a process where we observe divergences among financial assets, Fed Funds Futures pricings keep the US Central Bank's idea of 2 interest rate cuts by the end of the year on the agenda together with the CPI, but it was noteworthy that the FOMC Economic Projections revised the idea of 3 interest rate cuts for the end of the year to 1. However, despite this, the markets still insist on the idea of 2 interest rate cuts and especially the attitude in the US stock indices allows them to continue their movements with this idea. The daily loss for the parity, which closed at 1.2781 on the previous trading day, was 0.14%. The 1.2795 level can be followed in intraday upward movements. If this level is exceeded, the 1.2809 and 1.2817 resistances may become important. In possible pullbacks, 1.2765 and 1.2751 will be followed as support levels. Support: 1.2765 – 1.2751 Resistance: 1.2795 – 1.2809