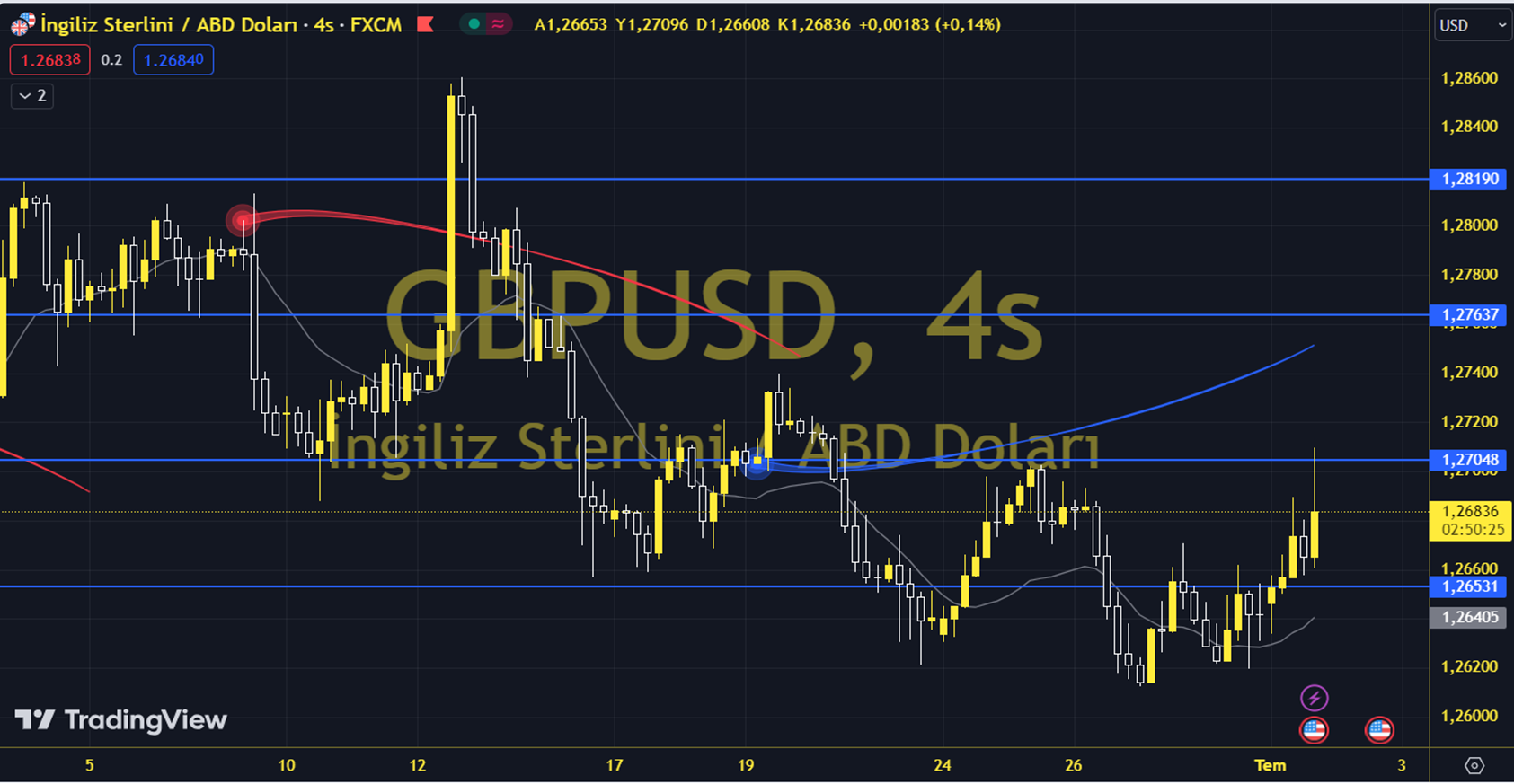

GBPUSD

We have left behind a day in which we followed the final results of the manufacturing PMI data. We observed a recovery from the bottom indicating that the contraction rate has decreased in Germany and the Euro Zone, and the continuity in the contraction zone and the increase in the contraction rate in the US. In addition, the fact that Germany's annual CPI data remained below expectations at 2.2% can be explained as a development supporting the ECB interest rate cut tempo. The fact that the Dollar Index remained above the reference indicators with the daily news flow allowed the pressure on the EURUSD and GBPUSD pairs to continue. The daily loss for the pair, which closed at 1.2633 on the previous trading day, was 0.13%. The RSI indicator for the exchange rate, which is below its 20-day moving average, is at 43.57, while its momentum is at 99.58. The 1.2649 level can be followed in intraday upward movements. If this level is exceeded, the 1.2664 and 1.2673 resistances may become important. In case of possible pullbacks, 1.2616 and 1.2601 will be monitored as support levels. Support: 1.2616 – 1.2601 Resistance: 1.2649 – 1.2664