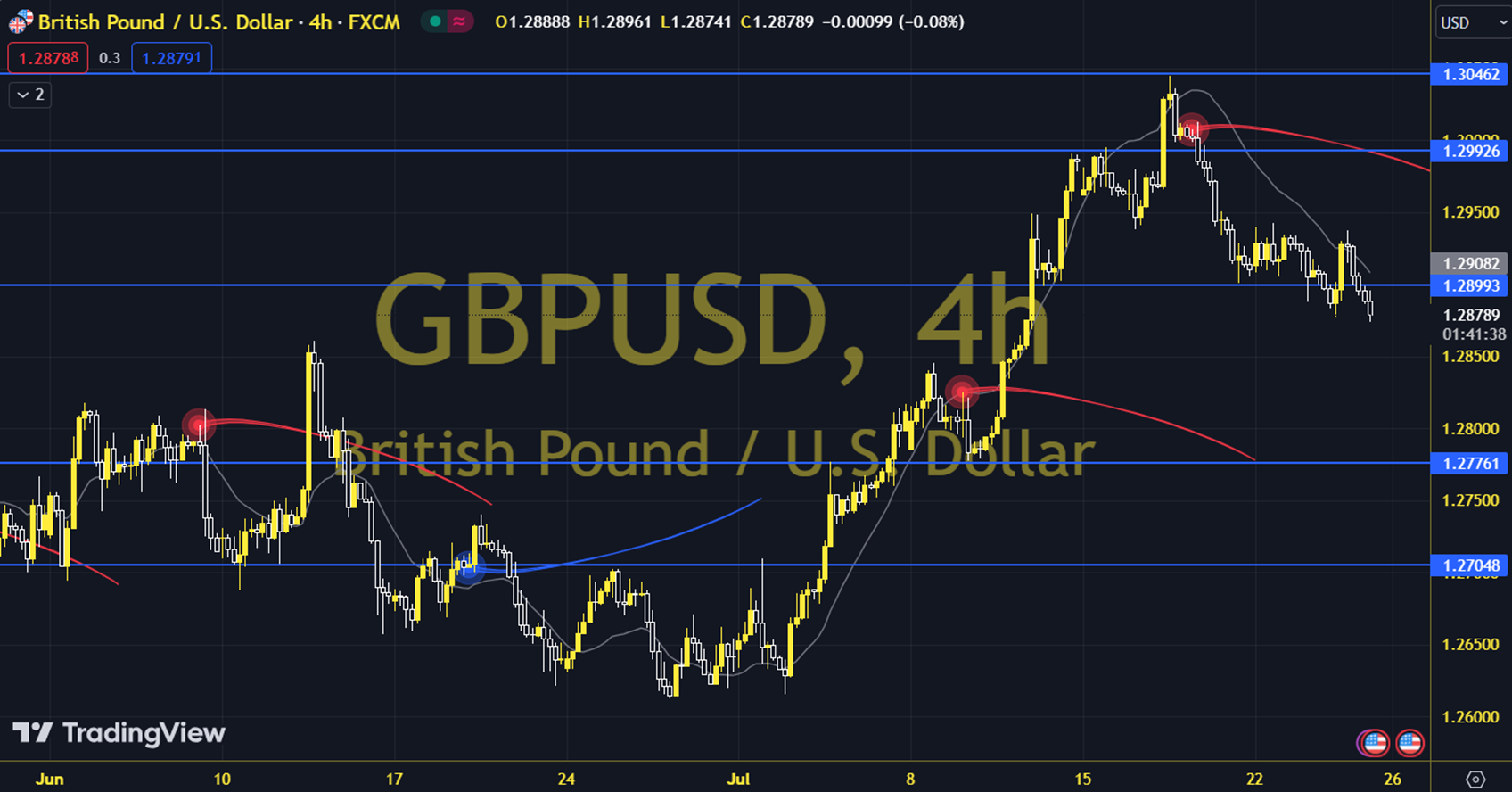

GBPUSD

As we complete July as of the new week, a very busy calendar awaits us for global markets. In terms of macro indicators, our focus will be on Nonfarm Payrolls and Average Hourly Earnings from the US, CPI from the Euro Zone, and PMI from China, while the Fed, BoE, and BoJ can be explained as critical headings in the Central Bank theme. While no interest rate change is expected from the Fed in the Central Bank traffic, we will follow whether the Bank / Powell will give an interest rate cut signal for September in light of the latest indicators. The downward movement observed in the dollar index supports the parity upwards. The daily gain for the parity, which closed at 1.2877 on the previous trading day, was 0.08%. The RSI indicator for the parity, which is below its 20-day moving average, is at 54.37, while its momentum is at 99.71. The 1.2864 level can be followed in intraday downward movements. If this level is dropped, the 1.2850 and 1.2838 supports may become important. In possible increases, 1.2902 and 1.2916 will be monitored as resistance levels. Support: 1.2864 - 1.2850 Resistance: 1.2902 - 1.2916