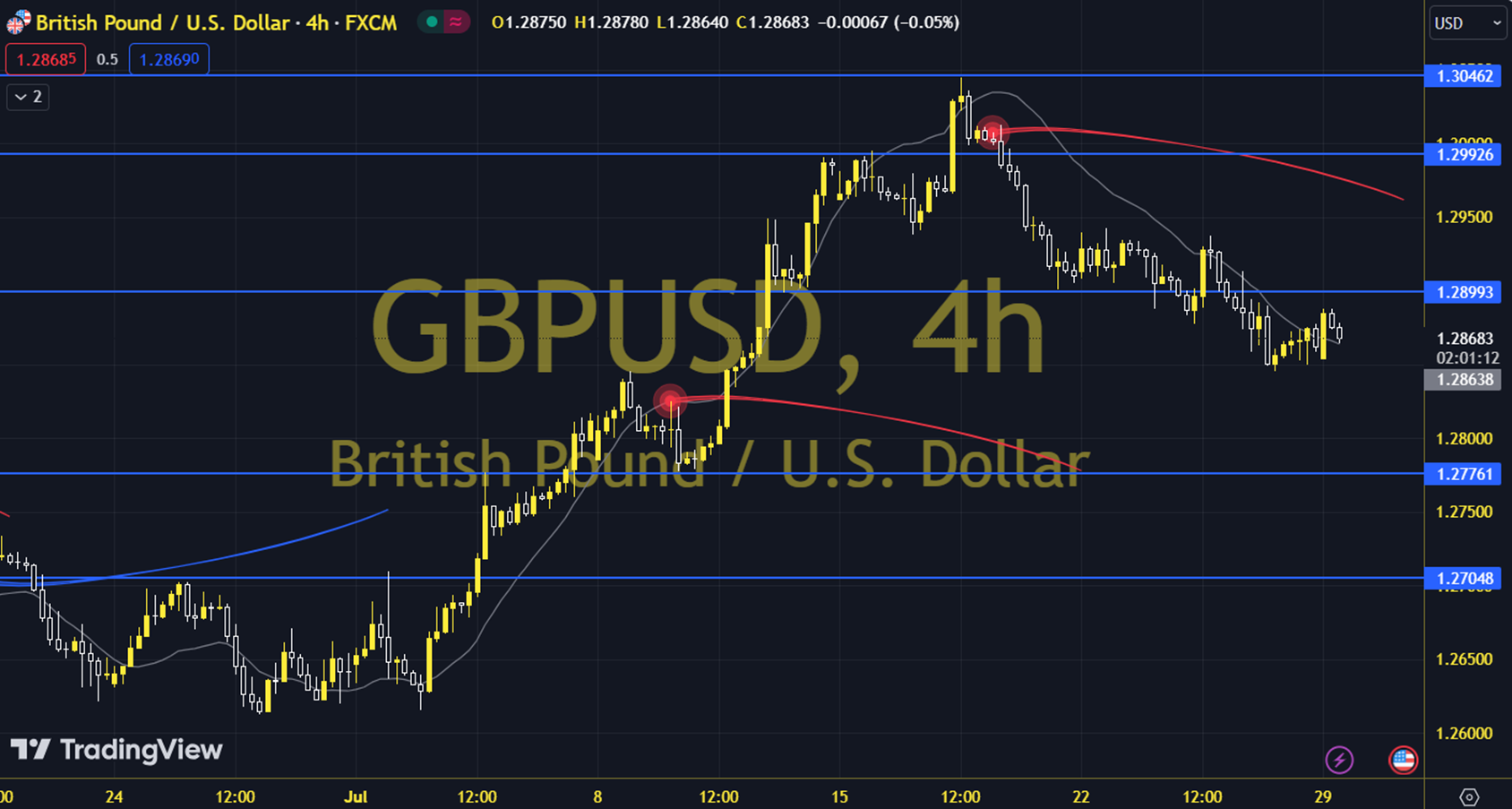

GBPUSD

We started the week with the theme of strong Dollar, weak Euro and Sterling. Although this theme brings short-term negative thinking to the agenda on the EURUSD and GBPUSD side, the Classic Dollar Index is not yet moving in the same direction. In the macro framework, our focus on indicators is Non-Farm Employment from the USA, CPI from the Euro Zone, and Fed, BoE and BoJ can be explained as critical headings in the Central Bank theme. Today, CPI from Germany and Conference Board (CB) Consumer Confidence and Job Openings and Labor Turnover Rate (JOLTS) data results from the USA can be followed. The daily loss for the parity, which closed at 1.2859 on the previous trading day, was 0.02%. The RSI indicator for the parity, which is below its 20-day moving average, is at 52.20, while its momentum is at 99.00. The 1.2847 level can be followed in intraday downward movements. In case of falling below this level, the supports at 1.2835 and 1.2825 may become important. In possible increases, 1.2869, 1.2879 and 1.2891 will be monitored as resistance levels. Support: 1.2847 - 1.2835 Resistance: 1.2869 - 1.2879