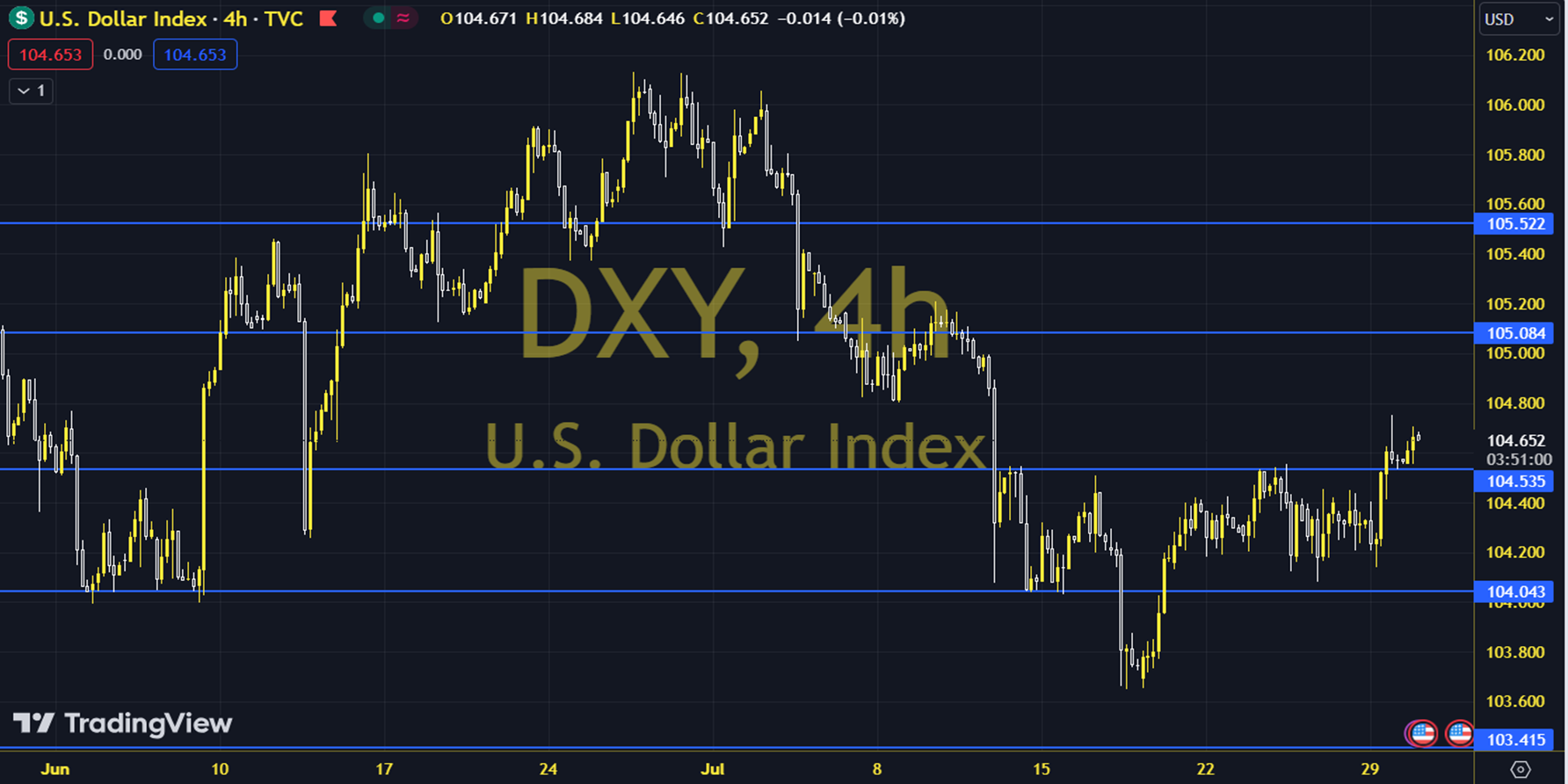

DXY

Before the critical agenda items, the Classic Dollar Index continues its course below the 104.50 - 105.00 range, which represents the 34 and 100-day averages, with the ending uptrend we base it on. Although the recent recovery in particular has created a profile that questions the new negative outlook, the index currently supports the new negative outlook with its course under the indicators. This week, the reaction it will give in the 104.50 - 105.00 range may be a roadmap for the answer to the question of whether it will be 107 or 102. Today, the results of the CPI from Germany and the Conference Board (CB) Consumer Confidence and Job Openings and Turnover Rate (JOLTS) data from the US can be followed. The 104.210 level can be followed in intraday downward movements. In case of falling below this level, the supports of 104.030 and 103.690 may become important. In possible increases, 104,630 and 104,750 will be monitored as resistance levels. Support: 104,210-104,030 Resistance: 104,630-104,750