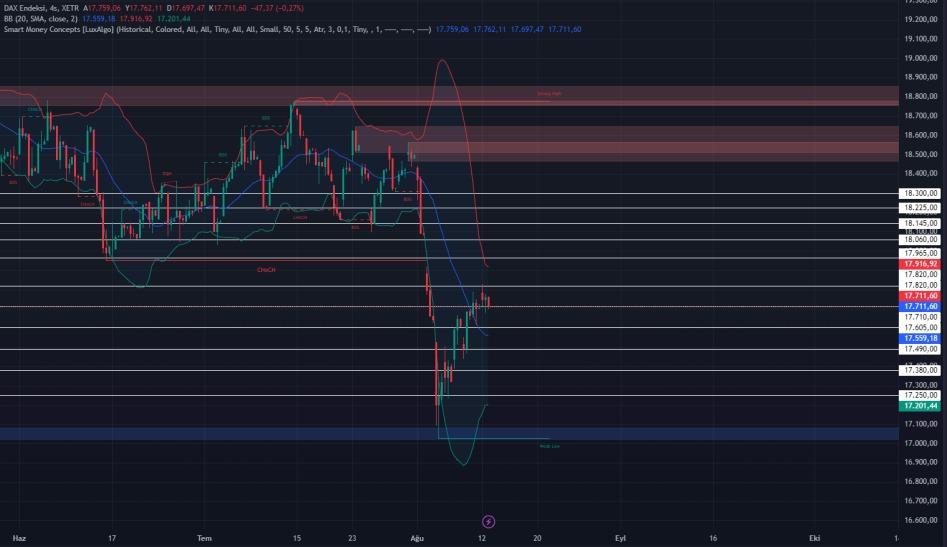

DAX

Ahead of the US CPI data, according to CME FedWatch data, the possibility of a 100 basis point rate cut by the end of the year is being priced in. The probability of a 25 basis point rate cut in September stands out with 50.5%. The latest employment data has increased the pressure on the Fed to cut interest rates, and the CPI data may be decisive in determining whether this pressure will continue. The CPI data can have significant effects on indicators such as the Dollar Index, US Treasury Bond Rates and the VIX, which can lead to sudden and volatile changes in financial markets. The ZEW Economic Sentiment from Germany and the Producer Price Index (PPI) from the US are also important data to follow today. Although the European indices started the week with some optimism, the Dax40 index has not yet moved into positive territory. The main indicator of the index is the 18310 level, and as long as it remains below this level, the negative outlook continues. However, whether the reaction purchases will continue with the recent increases can be monitored through the intermediate resistance level in the 17985 – 18082 region.