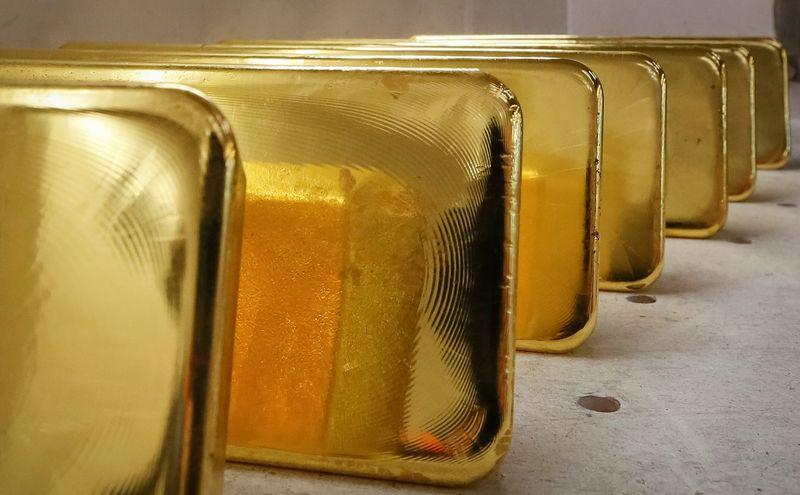

Gold rises as US jobs report points to new rate hikes

Gold rose in Asia on Monday morning, even as the U.S. jobs report pointed to new rate hikes that could put pressure on non-yielding bullion. Gold futures rose 0.32% to $1,856.20. Gold, which traded between $1,828 and $1,864 last week, has generally held at $1,850. The Fed is pushing ahead with half-point rate hikes in June, July and possibly beyond, as new labor market data suggests the U.S. economy is reeling from high inflation and rising borrowing costs. Gold fell after data on Friday showed U.S. employers hired more people in May than expected and wage growth is still strong. Meanwhile, investors have increased their bets that the European Central Bank will raise rates this year, pricing in a bigger 50-basis hike at one of the bank’s meetings before October. Higher interest rates would raise the opportunity cost of holding non-interest-bearing gold. On Friday, South African precious metals miner Sibanye Stillwater (NYSE:SBSW) said unions that launched a strike at its gold operations had received authorization from its members to accept a three-year wage deal. In addition, Ghana’s gold production fell 30% last year to the lowest level in a decade, according to the chamber of mines’ chief executive, eroding the country’s status as Africa’s largest producer. Gold discounts in India increased last week as prices rose and demand waned as the wedding season came to a close. Consumers in China remained cautious about buying bullion amid a gradual easing of restrictions. Among other metals, platinum rose 0.2% to $1,015.99 and palladium rose 0.9% to $1,993.52. Silver gained 0.1% to $21.92.