El-Erian: Fed may be about to make policy mistake

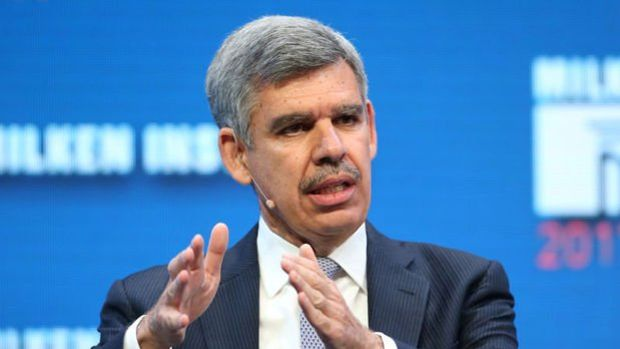

The Fed would make a big mistake if it skips a rate hike this week, senior economist Mohamed El-Erian warned in a Financial Times op-ed on Monday that “skipping” a rate hike would be “potentially the least desirable” of three options open to the central bank. Investors expect the Fed to hold borrowing rates steady on Wednesday and then tighten in July. Investors should prepare for a potential mistake when the Fed’s June meeting ends on Wednesday, according to Mohamed El-Erian. That approach, backed by top policymakers including board member Christopher Waller, would allow the central bank to watch another six weeks of economic data before deciding whether to wind down its war on inflation. But El-Erian, the former PIMCO co-CIO, criticized the idea of skipping, warning that the Fed would likely learn little about how its efforts to rein in rising prices are progressing between now and its next meeting, scheduled for July 25. “An additional month of data is unlikely to significantly improve the Fed’s understanding of the effects of a policy tool that moves with variable lags. Recent data supports a hike for a central bank that has consistently insisted it is ‘data-dependent,’” El-Erian said, likely referring to economic releases including May’s jobs report that indicated the U.S. labor market remains hot despite this. Instead of skipping a rate hike, the Fed should either raise borrowing costs again or signal a pause in its tightening campaign while adopting a new inflation target of 3% to 4%, El-Erian added.