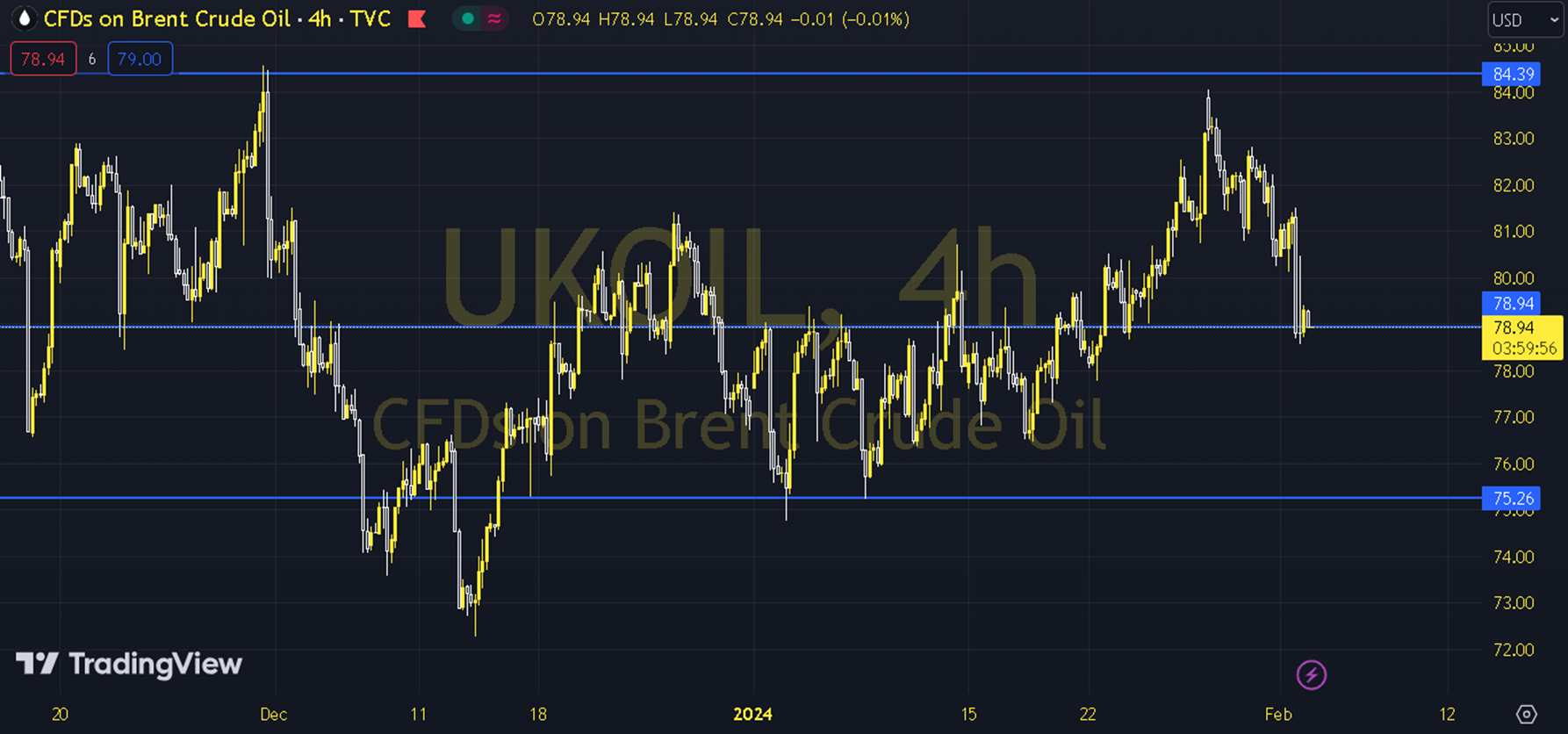

BRENT

The claim that progress has been made in the Israel-Hamas ceasefire talks plays an active role in suppressing oil prices. While the Hamas side has given a positive signal for the ceasefire, no statement has yet been made by the Israeli side. OPEC has decided to extend the production cut until April 3. However, we can say that this is a decision that remains in the shadows. The course of the European and US stock markets can be followed during the day. As long as the pricing remains below the 79.50-80.00 resistance in the upcoming period, a downward outlook may be at the forefront. In possible declines, the 78.50 and 78.00 levels can be targeted. As long as possible recoveries are limited to the 79.50-80.00 resistance, new downward potential may occur. Therefore, it may be necessary to see the course above 80.00 and 4-hour closings for the continuation of the upward desire. In this case, the 80.50 and 81.00 levels may come to the agenda. Support: 78.00 Resistance: 79.50