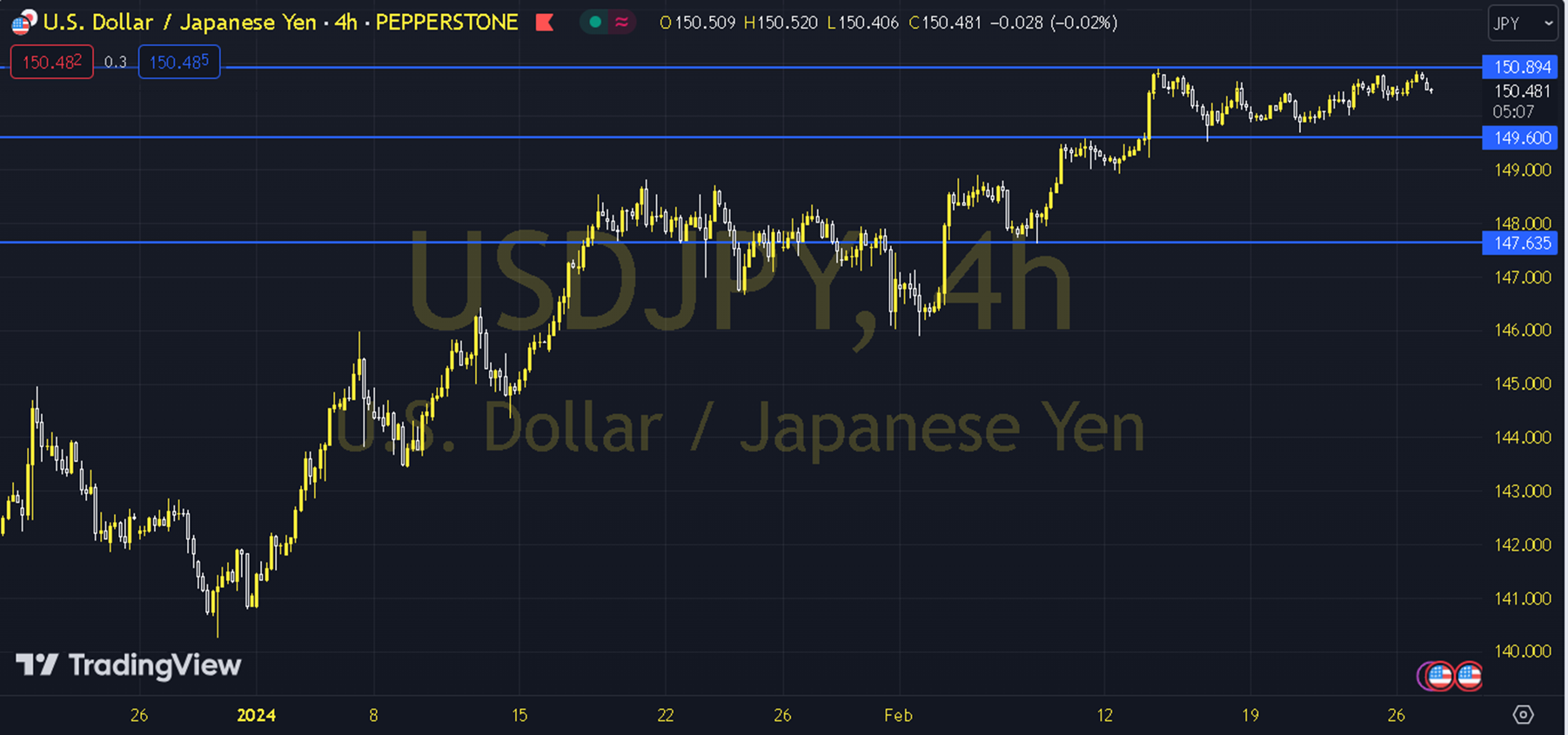

USDJPY

The USDJPY pair continues to struggle to gain momentum and traded in a narrow trading range yesterday. The short-term trend remains bearish following expectations that the BOJ will postpone its policy tightening plan amid the recession in Japan. Apart from this, expectations that the Fed will keep interest rates high for a longer period act as a supportive factor for the USDJPY pair. The daily loss for the pair, which closed at 150.43 on the previous trading day, was 0.17%. The RSI indicator for the pair, which is above its 20-day moving average, is at 62.48, while its momentum is at 100.76. The 150.52 level can be followed in intraday upward movements. If this level is exceeded, the resistances of 150.63, 150.84 and 150.95 may become important. In possible pullbacks, 150.31, 150.20 and 149.99 will be monitored as support levels. Support: 150,200 Resistance: 150,630