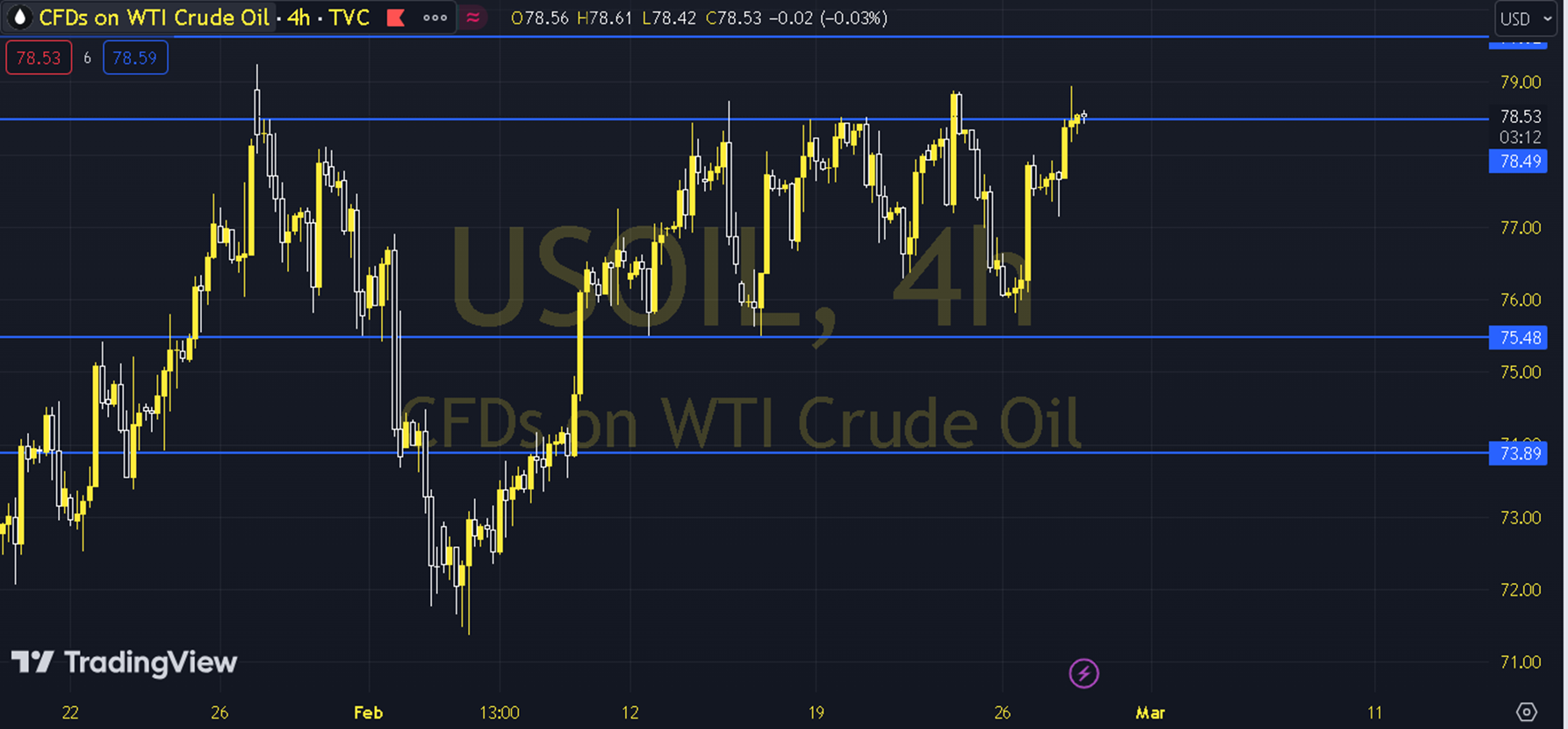

WTIUSD

In addition to the second estimate for US Q4 growth during the day, the official stock figures to be announced by the US Energy Information Administration will be monitored. If the agency confirms the increase in stocks, this will be the fifth week in a row that stocks have increased. While the 78.50 - 79.00 region is being questioned with the increase, whether the summit attempt is successful or not will depend on the attitude of this region, and if the peak cannot be formed, pullbacks may also develop accordingly. As long as pricing remains above the 77.50 - 78.00 support in the upcoming process, an upward outlook may be at the forefront. In possible increases, 79.00 and 79.50 levels may be targeted. In possible decreases, as long as the 77.50 - 78.00 support remains current, new upside potential may occur. Therefore, it may be necessary to see the course below 75.50 and hourly closings for the continuation of the downward desire. In this case, the 77.00 level may come to the agenda. Support: 77.50 Resistance: 79.50