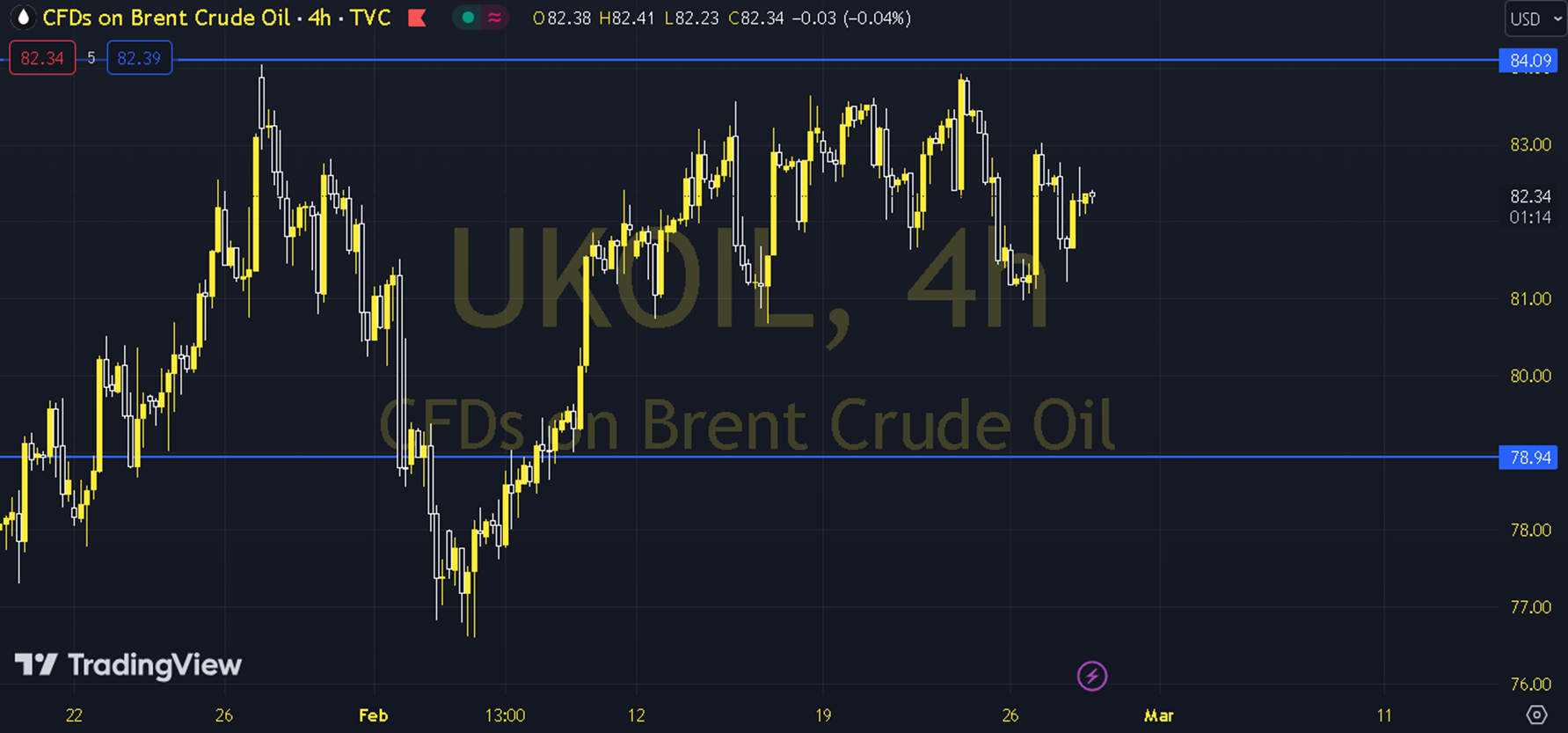

BRENT

Oil futures contracts started the week with limited profit sales after the gains they made since the beginning of the week with the expectation that OPEC+ will implement the production cut application in the second quarter. In addition to the second estimate for the US 4th quarter growth during the day, the official stock figures to be announced by the US Energy Information Administration will be followed. If the institution confirms the increase in stocks, this will be the fifth week in a row that stocks have increased. As long as the pricing remains at and above the 81.50 - 82.00 support in the upcoming process, an upward outlook may be at the forefront. In possible increases, the 83.00 and 83.50 levels may be targeted. In possible decreases, as long as the 81.50 - 82.00 support remains current, new upside potential may occur. Therefore, it may be necessary to see the course below 81.50 and hourly closings for the continuation of the downward desire. In this case, the 81.00 level may come to the agenda. Support: 81.50 Resistance: 83.50