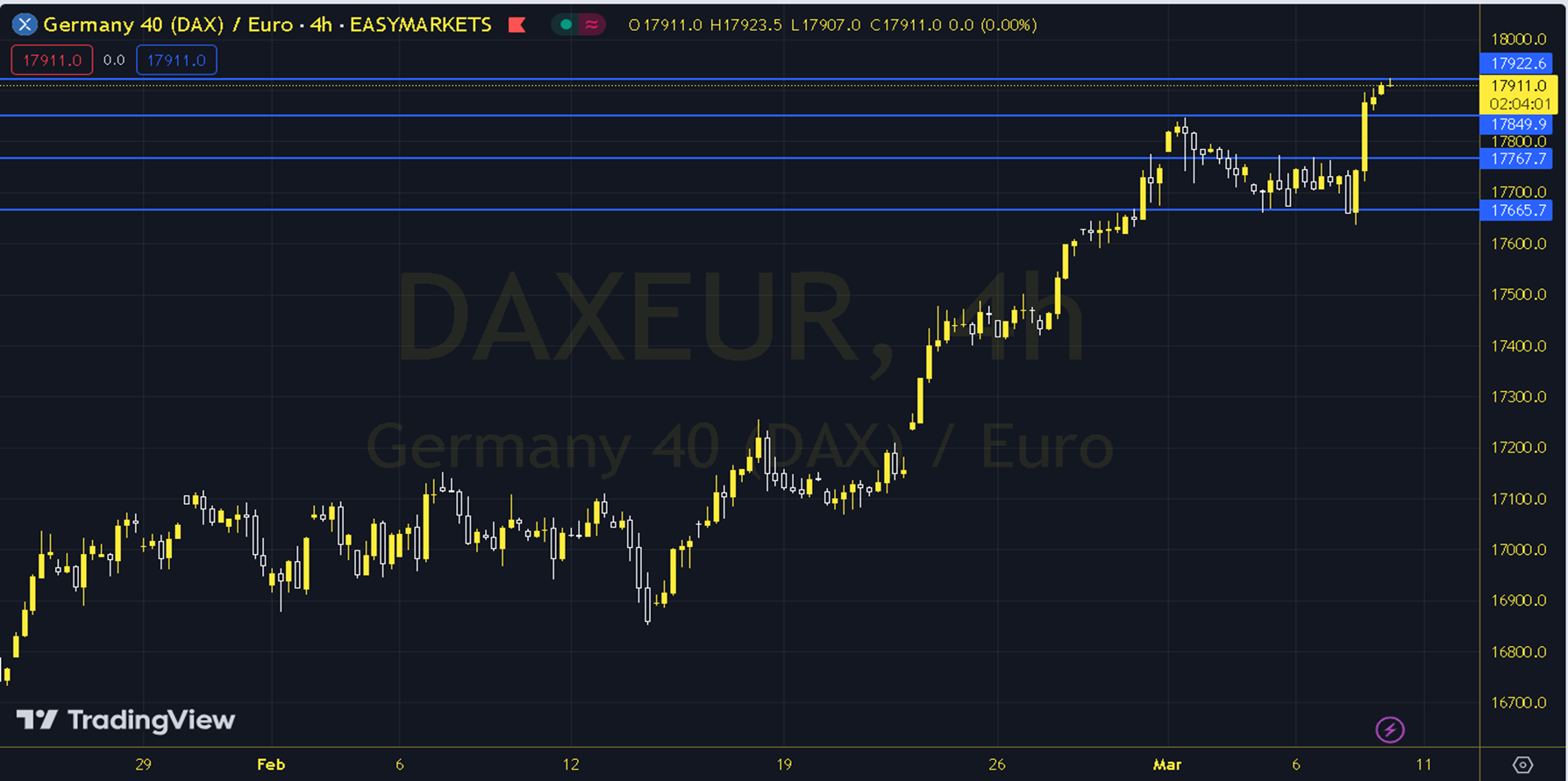

DAXEUR

Ahead of the US employment report, the stock markets showed recovery with the signals given by the US and European central bank presidents that interest rate cuts could be started this year. The US employment data set to be announced today will be closely monitored due to its effects on the DAXEUR index. When we examine the short-term chart of the DAXEUR index technically, we are following the 17700 -17800 region with support from the 20-period exponential moving average. As long as the index is above the relevant region, positive expectations are at the forefront. In increases, increases towards the 18000 level and then towards the 18100 level can be seen. In the alternative scenario, in possible suppression around the 17900 resistance, it is expected that the declines will accelerate with the index falling below the 17700 level for negative expectations. In this case, decreases towards the 17500 level with support from the 89-period average can be followed in the downward direction. Support: 17800 – 17700 Resistance: 18000 – 18100