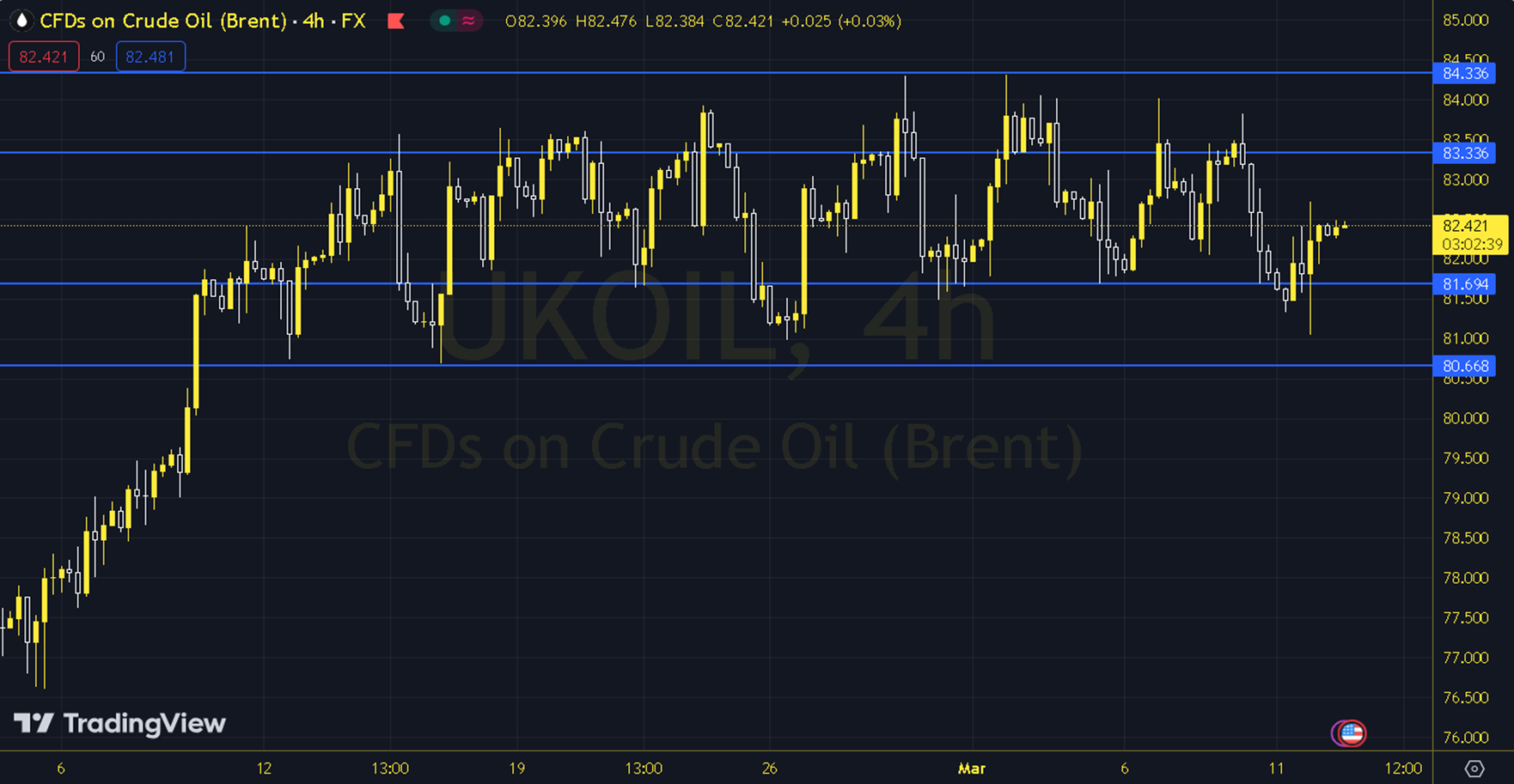

BRENT

Oil futures contracts have taken a calm course after yesterday's volatility. US February inflation and OPEC monthly report are among the headlines to be followed during the day. While OPEC+'s decision to extend the production cut and geopolitical risks were effective in upward movements, the pressure was mostly on high non-OPEC production levels and weak global demand. Inflation data and OPEC monthly report will be followed during the day. As long as pricing remains at and above the 81.50 - 82.00 support in the upcoming process, an upward outlook may be at the forefront. In possible increases, 83.00 and 83.50 levels may be targeted. As long as possible decreases are limited to the 81.50 - 82.00 support, new uptrend potential may occur. Therefore, it may be necessary to see the course below 81.50 and 4-hour closings for the continuation of the downtrend. In this case, 81.00 and 80.50 levels may come to the agenda. Support: 82.00 – 81.50 Resistance: 83.00 – 83.50