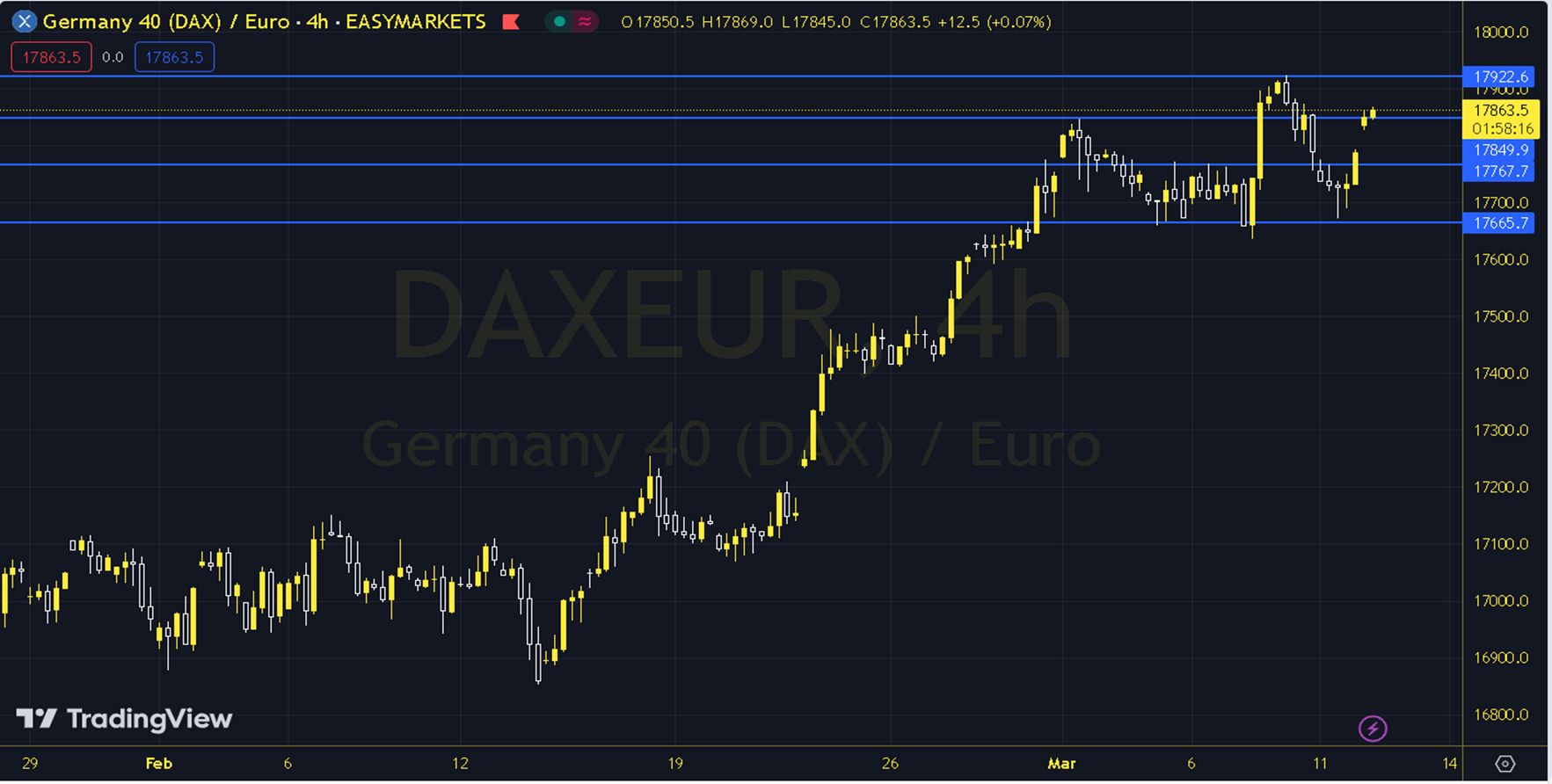

DAXEUR

We have left behind a day of weak risk appetite in European Indices. The DAXEUR index ended the day with a 0.8% decrease and started the new day positively. While the US inflation data is being followed globally today, the UK employment data also stands out as calendar data to be followed in terms of the course of the stock markets. When we examine the short-term chart of the DAXEUR index technically, we are following the 17900 - 18000 region with support from the 20-period exponential moving average. As long as the index moves above the relevant region, positive expectations are at the forefront. In increases, increases towards 18200 and then 18300 may be seen. In the alternative scenario, it is expected that the index will fall below the 17900- level for negative expectations in the possible suppression around the 18200 resistance and the pullbacks will accelerate. In this case, declines towards the 17600 level can be followed. Support: 17700 – 17600 Resistance: 17900 – 18000