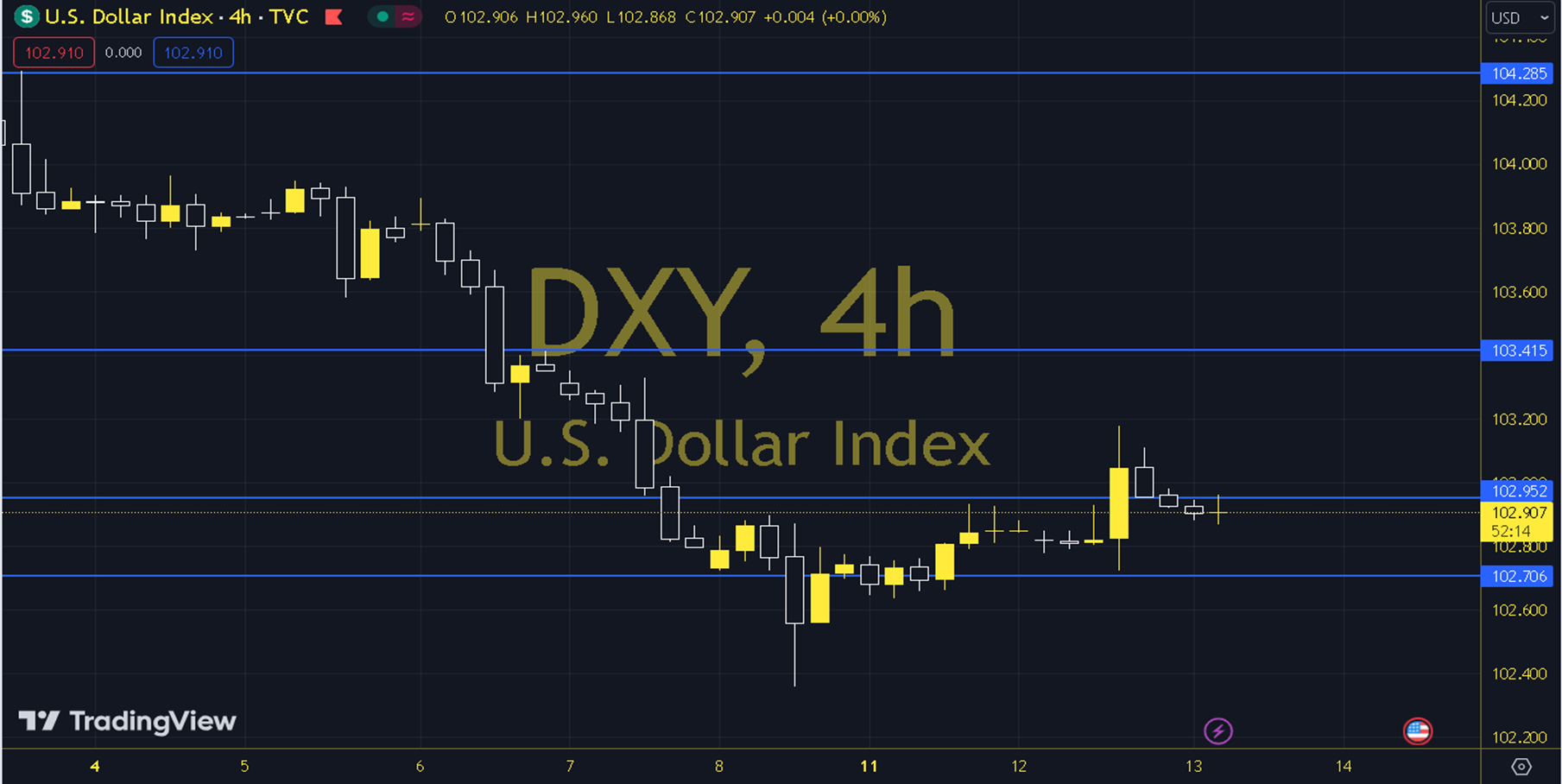

DXY

Following the CPI data announced yesterday, the Dollar Index rose to 103,180, thus regaining the losses it had incurred last week. 10-Year Bond Yields rose to 4.13, helping the DXY to rise. In addition, US stock index futures increased by 0.2% to 0.6% in the early Asian session, indicating a positive change in the risk atmosphere. Technically, in the short term, the 200-Day Moving Average range of 102,810 - 102,640 stands out as a support area. If this range is dropped below, the 50-Day Moving Average may continue to retreat to 102,370. In increases, the 100-Day Moving Average levels of 103,120 and 103,360 can be followed as resistance points. Support: 102,810-102,640 Resistance: 103,120-103,360