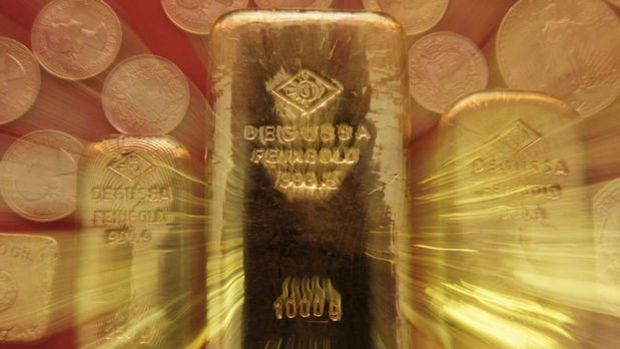

According to fund managers, the 'dizzying' rise in gold is not over

According to some fund managers who spoke to Bloomberg, the rally in gold, which has risen by about 20 percent since mid-February, is not over yet. According to some fund managers, the rapid increase in gold prices may continue. Factors such as the expectation that the Fed will cut interest rates this year and the conflicts in the Middle East and Ukraine have increased safe haven purchases, while gold purchases by central banks around the world have also supported prices. Rajeev De Mello of Gama Asset Management said, “The current momentum is a signal that gold assets will increase. There may be a small correction in prices, but any pullback will increase purchases even more.” Central bank purchases played an important role in the rise in gold. Central banks, especially China, bought over a thousand tons of gold to diversify their reserves in 2022 and 2023. Ruffer Investment Co. Investment Director Duncan MacInnes said, “These ounces will be withdrawn from the market and will never come back. This is definitely very different from the ETFs that everyone trades.” MacInnes increased his gold and silver holdings by 8 percent in his 2 portfolios last month. In this environment, unusually, demand for gold-backed Exchange Traded Funds (ETFs) has not yet materialized. It is stated that the increase in demand may also support gold prices. Cohen & Steers Commodity Strategist Ben Ross stated that when the Fed starts to cut interest rates, inflows to ETFs will also increase and the price of gold will rise.