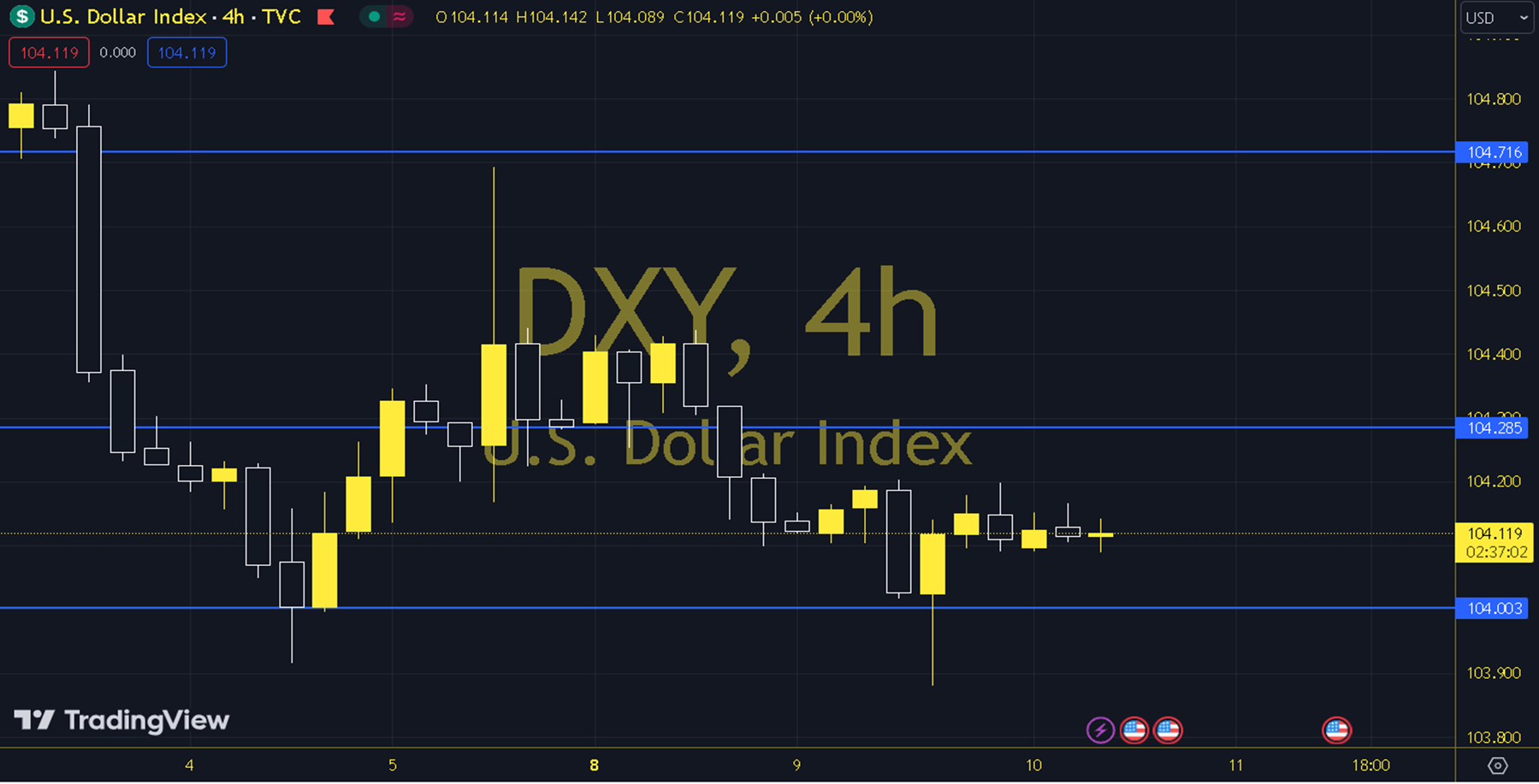

DXY

Although DXY saw 104.450 intraday on Monday, it later experienced a pullback to 104.130 due to the selling pressure. Our basic view is that DXY increases are a selling opportunity. Since this week is the Holiday Week, our investors should not be complacent, we will be waiting for extremely important data. Today's Inflation Data from the US, TUFE FOMC Minutes, Tomorrow, UFE and EURO will come, and Thursday's Interest Rate Decision will come. Technically, in the short term, the 200-Day Moving Average range of 104.020-103.850 stands out as a support area. If this range is dropped below, the pullback to the 50-Day Moving Average level of 103.570 may continue. In increases, the 100-Day Moving Average levels of 104.250-104.680 can be followed as resistance points. Support: 104,020-103,850 Resistance: 104,250-104,680