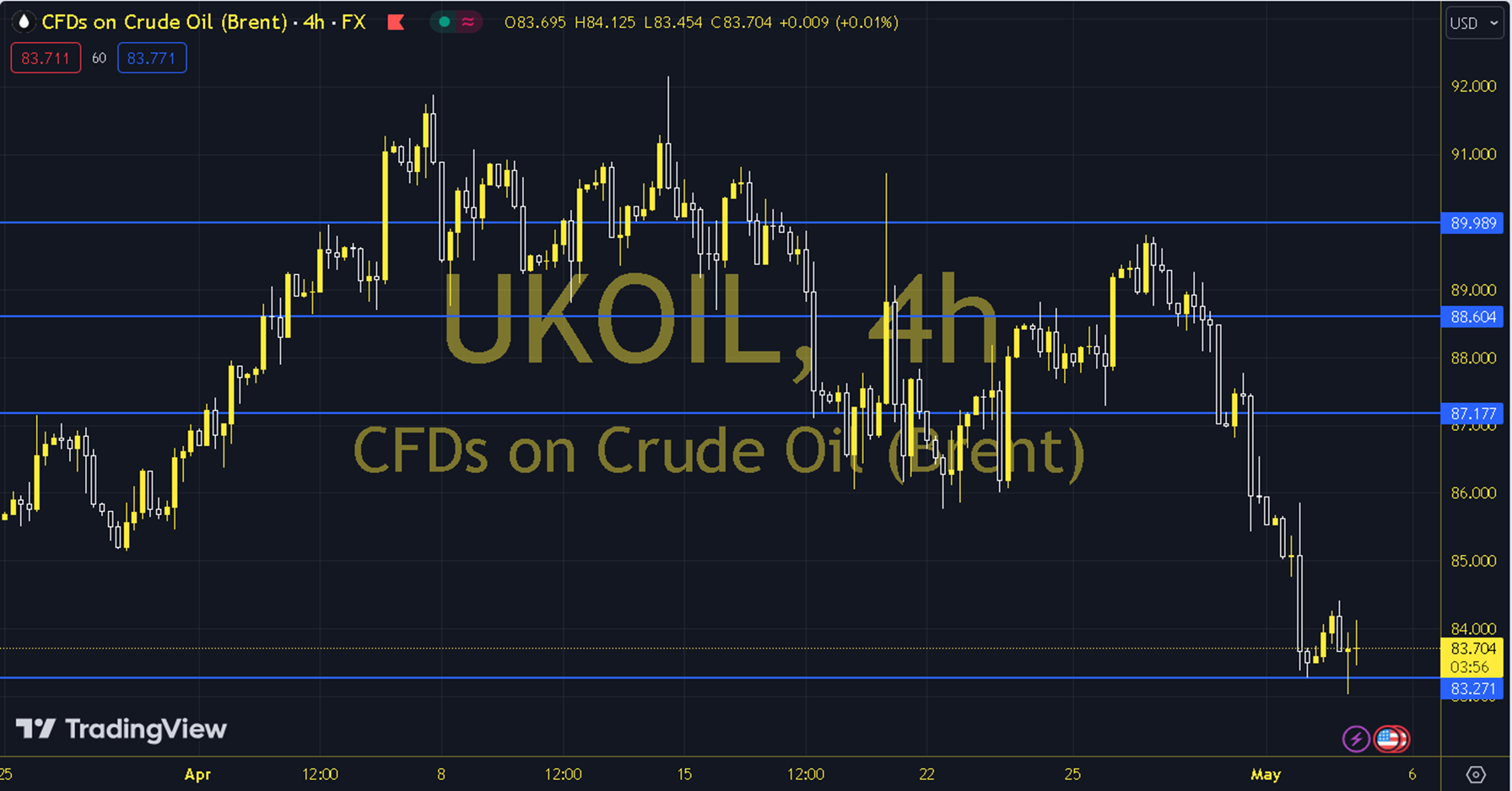

BRENT

Oil prices, after falling to their lowest levels in about a month and a half due to the decline in Middle East risk and increasing stocks in the US, made a limited recovery attempt in the Asian session. News that Hamas prepared a plan for a temporary ceasefire and planned to send delegates to Egypt for this purpose was effective in this situation. The course of European and US stock exchanges and the data flow on the US side can be followed during the day. In general, a downward trend is seen. Brent oil saw a high of 84.28 and a low of 82.93 on the previous trading day. Brent oil, which followed a buying trend on the last trading day, gained 0.17% daily. The RSI indicator for the commodity, which is below its 20-day moving average, is at 35.04, while its momentum is at 93.51. The 83.60 level can be followed in intraday upward movements. If this level is exceeded, the resistances of 84.27, 84.95 and 85.63 may become important. In case of possible pullbacks, 82.92, 82.25 and 81.57 will be monitored as support levels. Support: 82.92 – 82.25 Resistance: 84.27 – 84.95