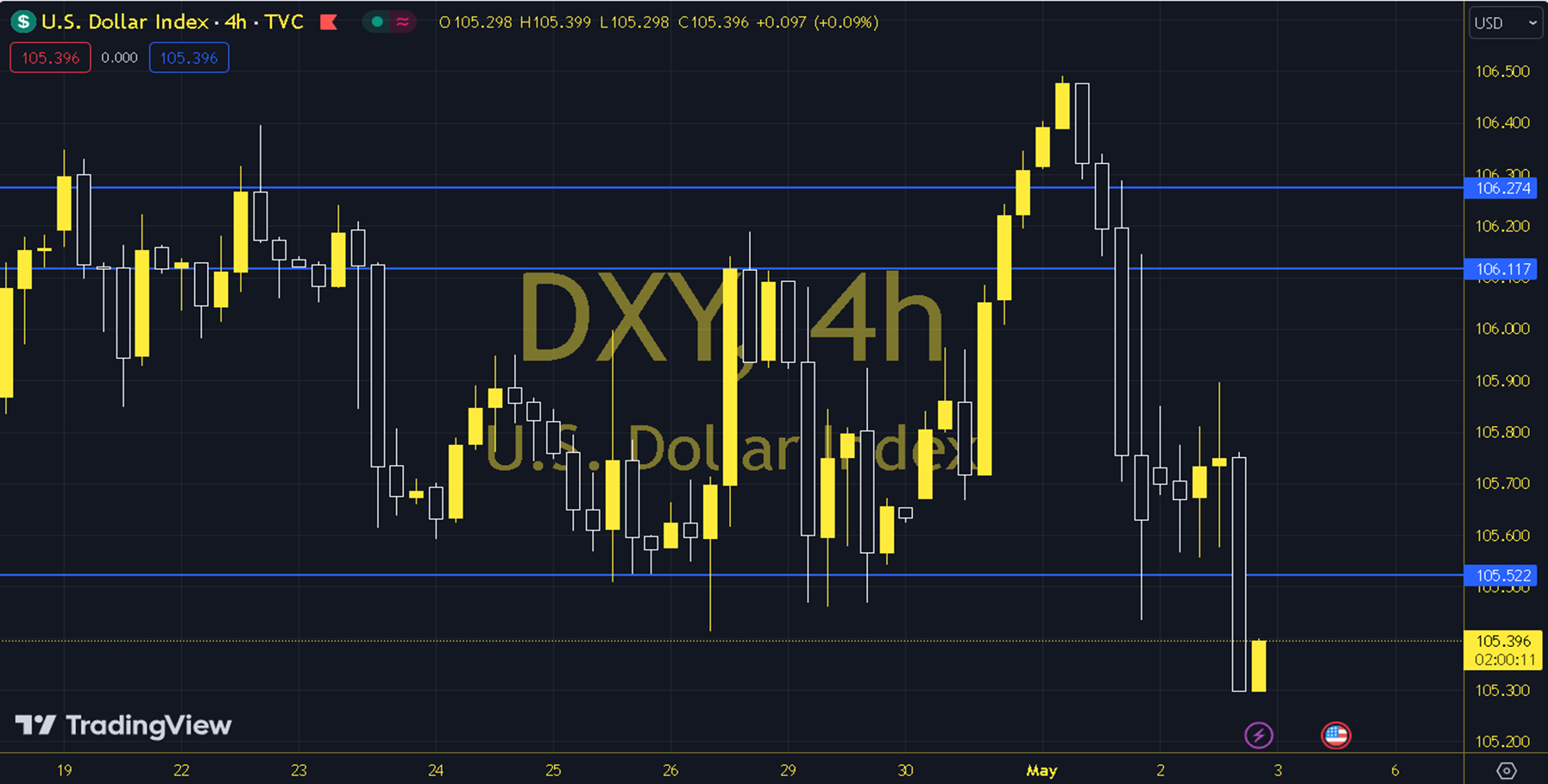

DXY

It is the last trading day of the week. All eyes will now be on the Nonfarm Payrolls and Average Hourly Earnings/Income data. Both the employment market and whether wage increases will create additional pressure on inflation are the main developments that will be included in today's pricing area. While the losses in the Classic Dollar Index are noteworthy ahead of the critical US data, we observe that the relevant losses are approaching the 34 and 100-day averages (104.14 - 104.94 region) that support the positive trend. Despite the recent decline, the strong dollar sentiment continues due to the expectation that the index can reach the 107 level tested in October 2023. The 105.100 level can be followed in intraday downward movements. If this level is dropped, the 104.840 support may become important. In possible increases, 105,380 and 105,650 will be monitored as resistance levels. Support: 105,100-104,840 Resistance: 105,380-105,650