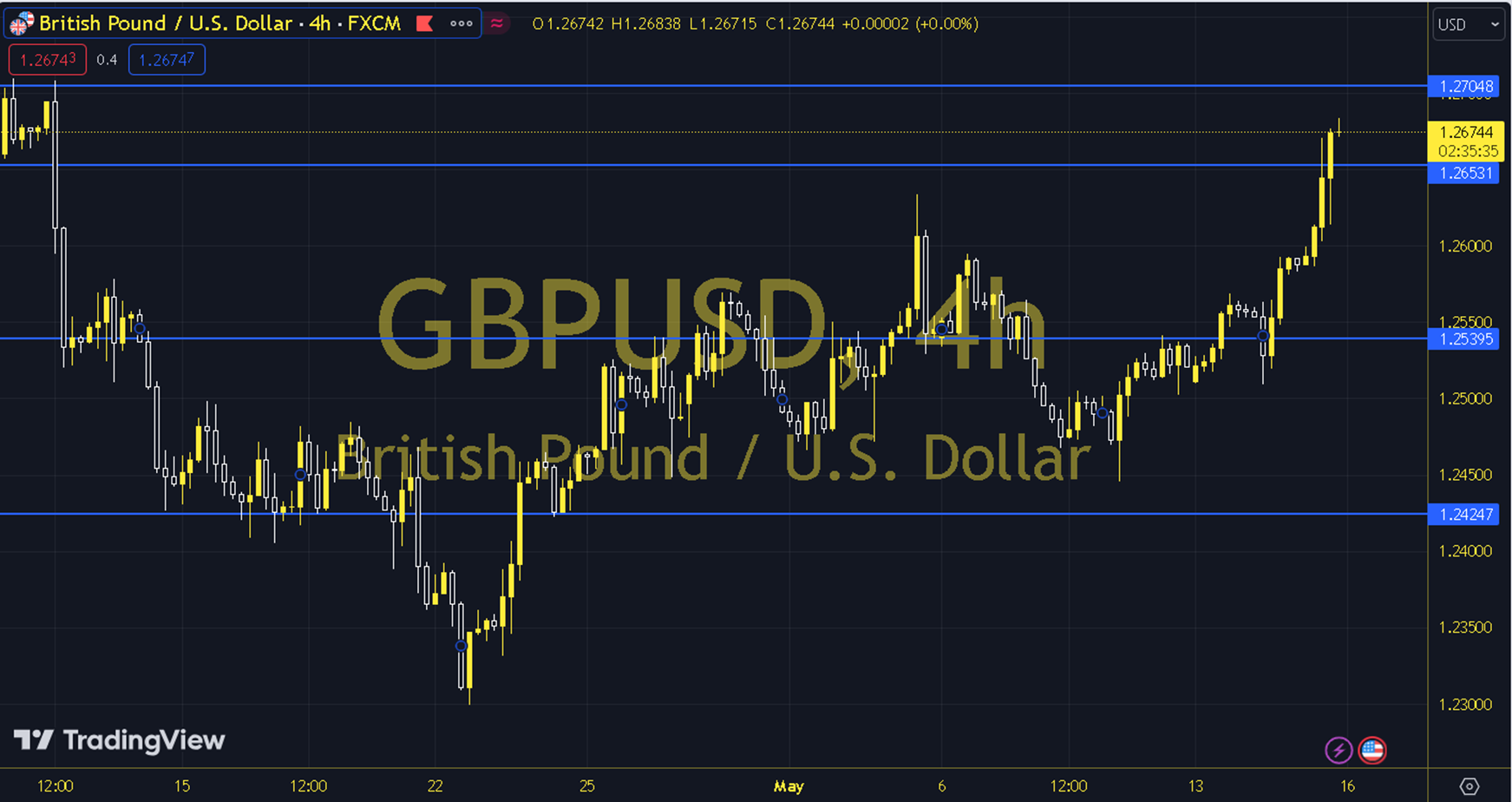

GBPUSD

We observe that markets that were caught in fear with the March CPI data have largely cleared up their current fears with the April CPI data. Although a performance below the March figures was displayed on an annual basis, the results that were parallel to expectations ensure that the rigidity issue in inflation occupies the agenda. In this respect, we can focus more on the results of the PCE data, the Fed's inflation indicator, at the end of the month. For now, the idea that 2 interest rate cuts may be made in 2024 (CME FedWatch) continues. While the decrease in fears on the pricing side created significant pressure on the Dollar Index, the increases in EURUSD and GBPUSD parities drew attention. The 1.2688 level can be followed in intraday downward movements. In case of falling below this level, the supports of 1.2675, 1.2661 and 1.2648 may become important. In possible increases, 1.2702, 1.2715 and 1.2729 will be monitored as resistance levels. Support: 1.2675 – 1.2661 Resistance: 1.2702 – 1.2715