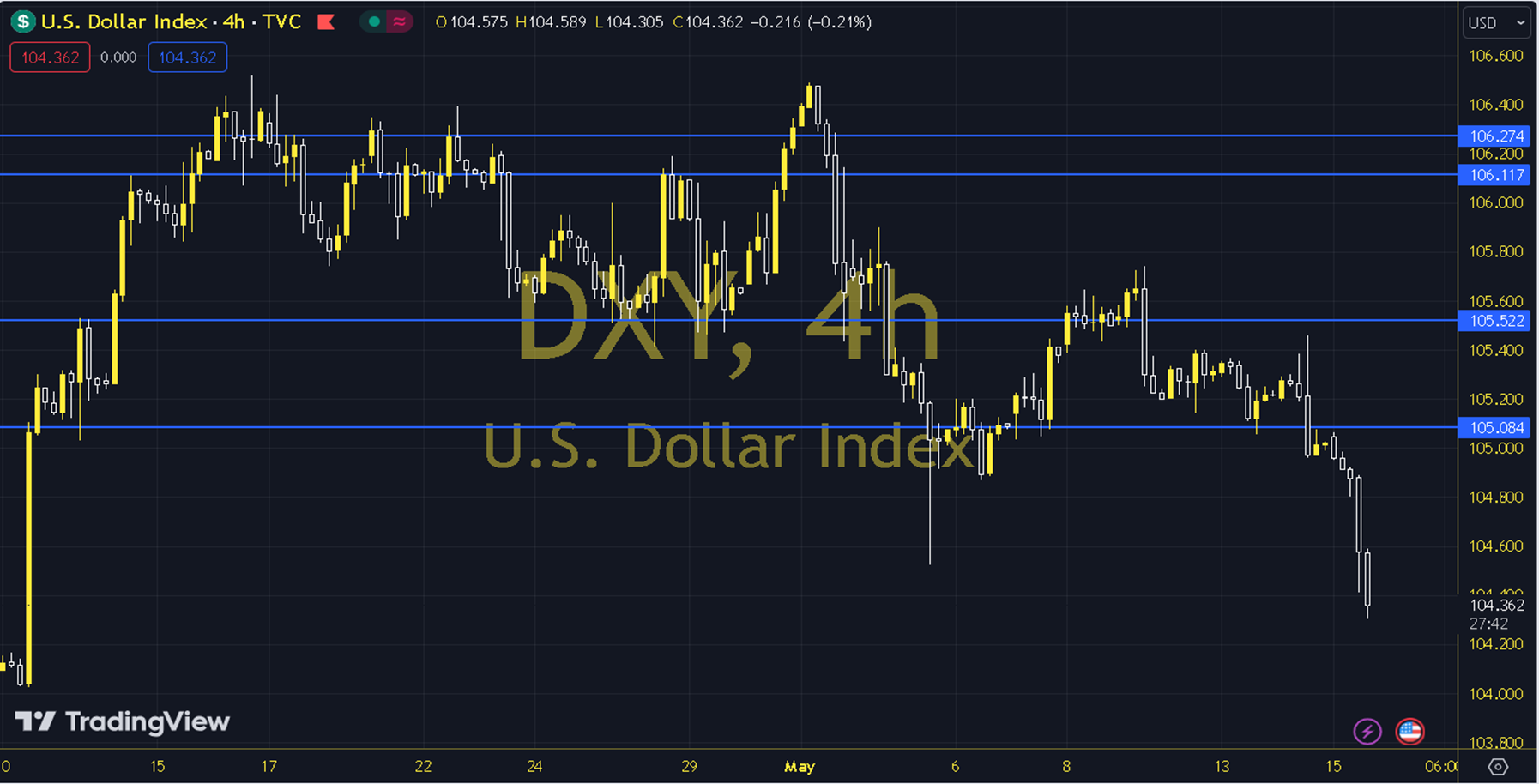

DXY

We observe that markets that were caught in fear with the March CPI data have largely cleared up their current fears with the April CPI data. Although a performance below the March figures was displayed on an annual basis, the results that were parallel to expectations ensure that the rigidity issue in inflation occupies the agenda. In this respect, we can focus more on the results of the PCE data, the Fed's inflation indicator, at the end of the month. While the decrease in fears on the pricing side creates significant pressure on the Dollar Index, we will pay attention to its performance in the remaining days of the week to see if it can put an end to the expectation of an increase below the 34 and 100-day averages (104.28 - 104.96). The 104.160 level can be followed in intraday downward movements. If this level is dropped, the support of 103.810 may become important. In possible increases, 104,480 and 104,750 will be monitored as resistance levels. Support: 104,160-103,810 Resistance: 104,480-104,750